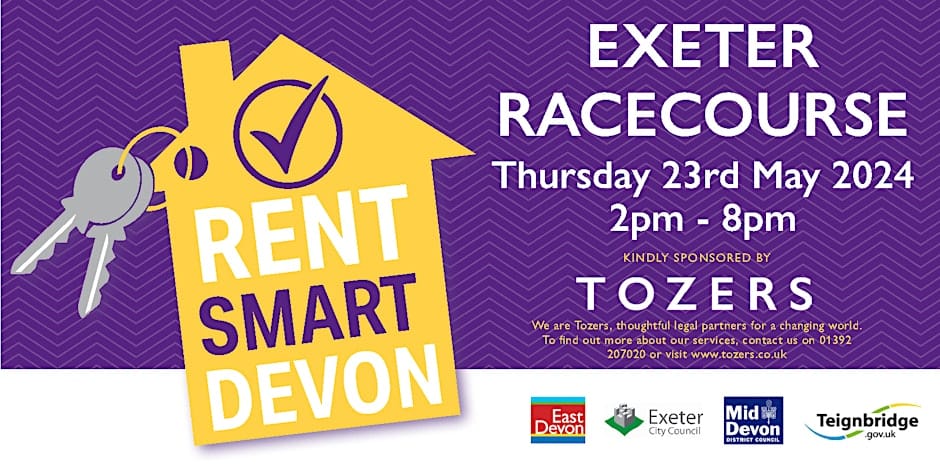

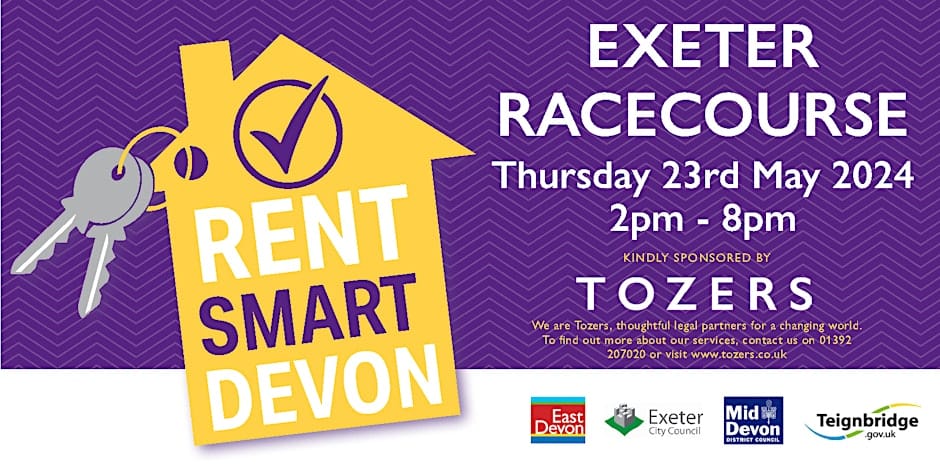

RENT SMART DEVON – Free Landlord Open Event – 23 May 2024 – Exeter Racecourse

Teignbridge is hosting the following event jointly with East Devon District Council, Exeter City Council and Mid Devon District Council. SWLA have a stand at

Teignbridge is hosting the following event jointly with East Devon District Council, Exeter City Council and Mid Devon District Council. SWLA have a stand at

Meter tampering is a significant challenge in the housing sector as it impacts landlords, tenants and the wider community and can destroy homes, businesses, and

HMO Licencing fee changes come into effect on 1st April 2024 The fees are to be increased in line with the 6% uplift across the

FRIDAY 8th MARCH 2024 – TUESDAY 12th MARCH 2024

Local Housing Allowance (LHA) determines the maximum financial support available for renters in the private rented sector. The Secretary of State has committed to reviewing the

Bristol City Council’s Cabinet has now approved the two new schemes which were subject to a consultation last year. The two new schemes will come

Landlord Accreditation Training Course – ONLINE Wednesday 1st May 2024 – 9:00 – 4:30pm Venue – Online Price – £65 for members of SWLA, £75

Thank you to members who attended our AGM this week, and thanks to members who sent their apologies. Steve Lees, SWLA Chair, lead the evening,

We often meet Shelter and Citizens Advice representatives at local housing meetings, so it was a welcome change to welcome Jack, Jaroslava and Sarah to