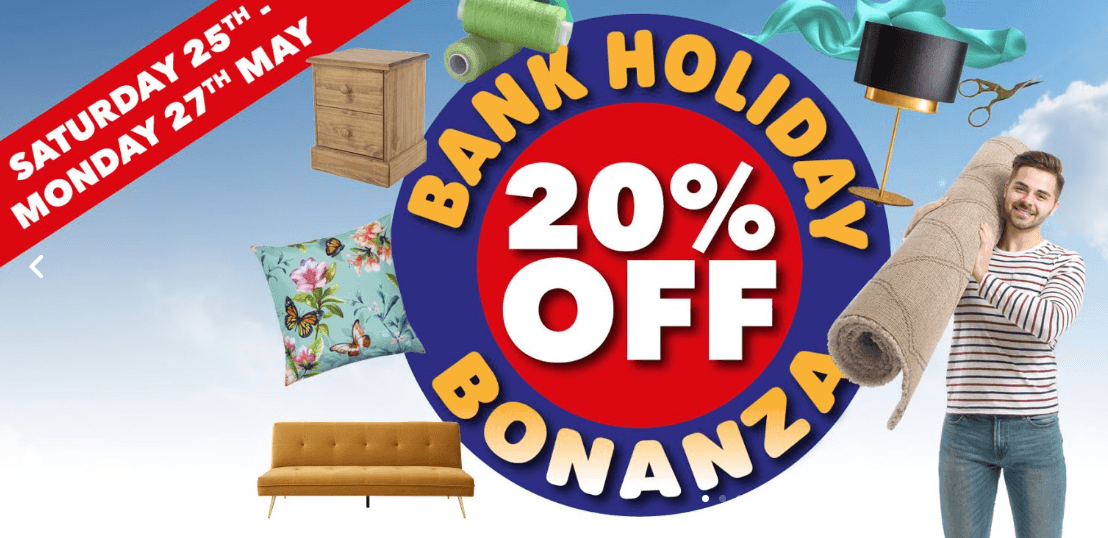

SWLA Trago2Business Members – 20% Off This Bank Holiday Weekend at Trago Mills!!

Saturday 25th May until Monday 27th May 2024. Usual exemptions apply. If you are an SWLA member and have not yet applied for your

Saturday 25th May until Monday 27th May 2024. Usual exemptions apply. If you are an SWLA member and have not yet applied for your

This month’s 30 minute Ashley Taylors Legal Webinar looks at the issues and problems that are arising with the Renters Reform proposals. It’s worth knowing

Landlord Accreditation Training Course – Face to Face Thursday 3rd October 2024 – 9:15 – 4:30pm Venue – Reception Room, Plymouth Council House, Armada Way,

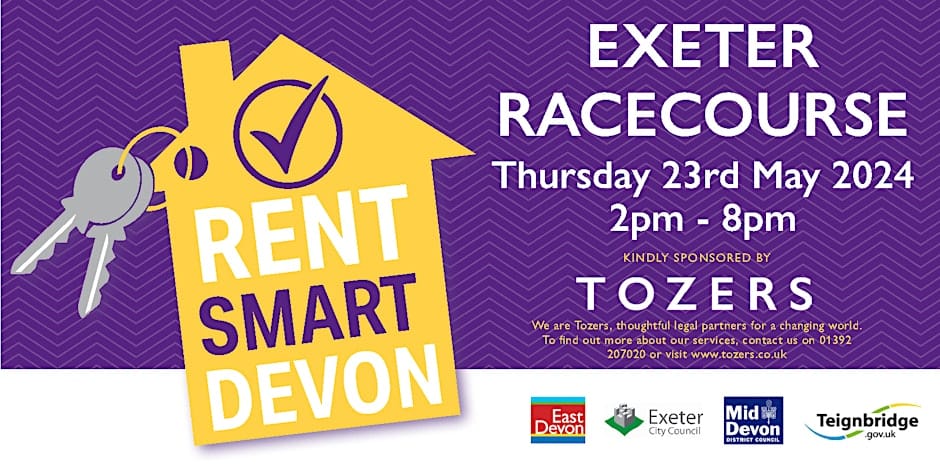

Teignbridge is hosting the following event jointly with East Devon District Council, Exeter City Council and Mid Devon District Council. SWLA have a stand at

Waste and HMOs: A Guide for Landlords and Managing Agents – by Plymouth City Council HMOs (Houses of Multiple Occupation) can present unique challenges when

Book your tickets to update your knowledge on property investing and learn from experts. For further information and to book your ticket please click here;

SWLA are excited to announce a new insurance partnership with Alan Boswell Group. We can also confirm that Oakfield Insurance are continuing their long standing partnership with

Possession Claims will increase from £355.00 to £391.00. Issuing a Warrant of Possession (the Bailiff application fee) will increase from £130.00 to £143.00. These increases

It was lovely to see many members, old and new, at our General Speaker Meeting this week. Thank you to Phil Keddie, Expert Property Consultant

New proposed amendments to the Renters (Reform) Bill have been revealed. The amendments appear to be sensible solutions to a few sticking points in the

For all deals please see the TradePoint website; TradePoint deals and promotions | Trade building supplies | TradePoint (trade-point.co.uk)

Homes in England with no residents will attract a council tax premium of up to 100% from 01 April as tax reforms aimed at supporting

Company No: 03670683 Registered Address: SWLA, 30 Dale Road, Plymouth, PL4 6PD – Website by GSL Media

Copyright © 2023 SWLA. All rights reserved