Proposed Rental (Reform) Bill Amendments

New proposed amendments to the Renters (Reform) Bill have been revealed. The amendments appear to be sensible solutions to a few sticking points in the

New proposed amendments to the Renters (Reform) Bill have been revealed. The amendments appear to be sensible solutions to a few sticking points in the

For all deals please see the TradePoint website; TradePoint deals and promotions | Trade building supplies | TradePoint (trade-point.co.uk)

Homes in England with no residents will attract a council tax premium of up to 100% from 01 April as tax reforms aimed at supporting

Wednesday 17th April 2024 – Future Inn Plymouth – 7.30pm start – Members & their guests welcome.

Plymouth Energy Community (PEC) is an award-winning local charity with 10 years of experience supporting households in Plymouth. Its Future Fit team is working in partnership

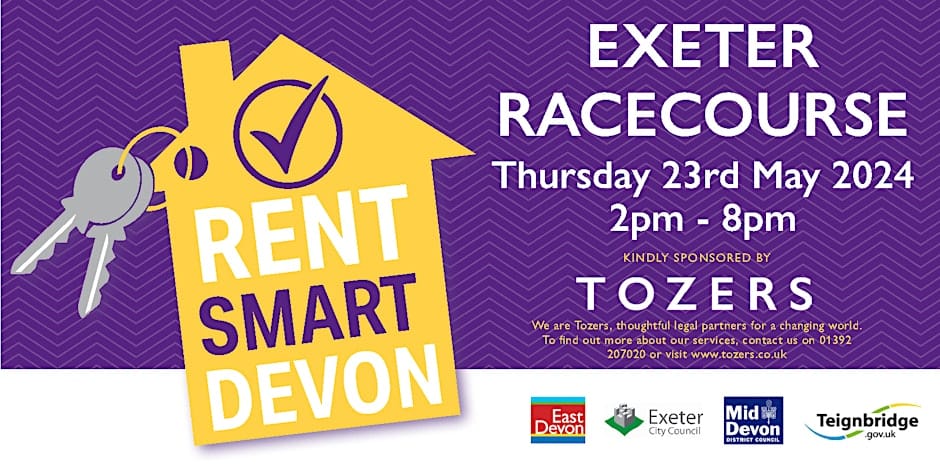

Teignbridge is hosting the following event jointly with East Devon District Council, Exeter City Council and Mid Devon District Council. SWLA have a stand at

Meter tampering is a significant challenge in the housing sector as it impacts landlords, tenants and the wider community and can destroy homes, businesses, and

HMO Licencing fee changes come into effect on 1st April 2024 The fees are to be increased in line with the 6% uplift across the

FRIDAY 8th MARCH 2024 – TUESDAY 12th MARCH 2024

Local Housing Allowance (LHA) determines the maximum financial support available for renters in the private rented sector. The Secretary of State has committed to reviewing the

Bristol City Council’s Cabinet has now approved the two new schemes which were subject to a consultation last year. The two new schemes will come

Company No: 03670683 Registered Address: SWLA, 30 Dale Road, Plymouth, PL4 6PD – Website by GSL Media

Copyright © 2023 SWLA. All rights reserved