GAS SAFETY WEEK 2024

Gas Safety Week: Every check counts- Landlords’ legal responsibilities We are proud to be supporting Gas Safety Week 2024, taking place 9th-15th September. Gas

Gas Safety Week: Every check counts- Landlords’ legal responsibilities We are proud to be supporting Gas Safety Week 2024, taking place 9th-15th September. Gas

To secure your place at the 87th National Landlord Investment Show in Bristol, visit www.landlordinvestmentshow.co.uk/25-september-bristol and simply register for free show tickets. __________________________________________________________________________________________________________ The

Landlord Accreditation Training Course – Face to Face Thursday 3rd October 2024 – 9:15 – 4:30pm Venue – Reception Room, Plymouth Council House, Armada Way,

Labour has confirmed plans for all rented properties to achieve a minimum Energy Performance Certificate (EPC) grade C by 2030. This initiative was confirmed by

The Housing Minister (Matthew Pennycook) has ruled out the introduction of rent controls in England. The comments were made in a written response to a

The Bank of England has cut interest rates from 5.25% to 5%, the first drop since the onset of the pandemic in March 2020. Home

Over 40 Bills were announced at the State Opening of Parliament (in the King’s speech) on 17th July, including the Renters’ Rights Bill. Commentary about

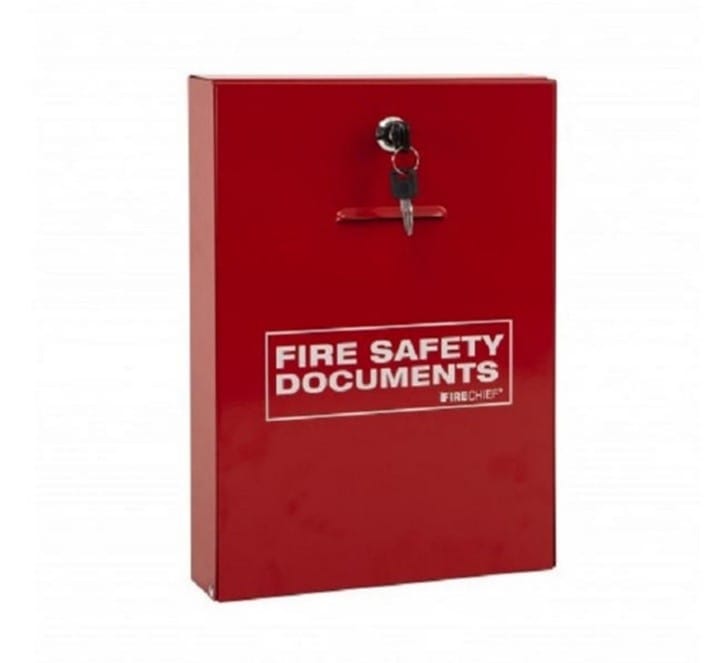

There is an item that you can place within a communal area of Flats or HMOs that can make a huge difference to the fire

It was great to see members old and new attend our open office event! We all had a lovely time catching up with everyone (and

Angela Rayner has been made Deputy Prime Minister and Secretary of State for the Ministry of Housing, Communities and Local Government. The department, which has

As Plymouth’s largest blinds showroom, Beacon Blinds stocks a comprehensive range of blinds, curtains and awnings. They are a local blinds supplier providing great value