Landlord Accreditation Training Course – ONLINE

Wednesday 13th October 2021 – 9:00 – 4:30pm

Venue – Online

Price – £65 for members of SWLA, £75 for non – members for one day course.

Course covers ASTs, Deposits, Section 21s, Section 8s, HMOs, Gas and Electrical Safety, Inventories and much more.

The course will provide you with all the skills to start, manage and finish a tenancy.

Places still available. Contact the office on 01752 510913 or info@landlordssouthwest.co.uk to book your place, places only secured on receipt of payment.

Over 990 landlords have already completed this course since September 2011.

Course can lead to Accreditation, if required.

We are proud to announce Landlord Accreditation South West (LASW) are founder members of the West of England Rental Standard.

As a result of the government’s announcement on 14 June 2021 to extend the date for the easing of lockdown restrictions and social distancing measures, the temporary COVID-19 adjusted right to rent checks will now end on 31 August 2021. From 1 September 2021, landlords and letting agents will revert to face-to-face and physical document checks as set out in legislation and guidance. This will ensure landlords and letting agents have sufficient notice to put measures in place to enable face-to-face document checks.

COVID adjusted right to rent checks are carried out remotely as follows:

Many landlords have continued to check their prospective tenant’s right to rent in person throughout the COVID period, this is acceptable, the adjusted measures are a temporary alternative. There is no requirement to carry out retrospective checks on those who had a COVID adjusted check between 30 March 2020 and 31 August 2021 (inclusive).

For further information; https://www.gov.uk/guidance/coronavirus-covid-19-landlord-right-to-rent-checks

**PLEASE NOTE – THIS IS NOT AN SWLA WEBINAR – PLEASE SIGN UP BY CLICKING THE LINK BELOW IF YOU WISH TO ATTEND**

Martyn Taylor of Ashley Taylors Legal invites all SWLA members to the following free landlord webinar;

When – 11am Friday 18th June 2021

Subject- Why am I fighting a disrepair claim when there’s nothing wrong with my property?

Where- Zoom

Martyn will be looking at disrepair defences being commonly used as a delaying tactic by tenants who do not want their landlord claiming possession. Is there a way to avoid this situation? There are many ways of reducing your exposure to this ever increasing risk. The first is knowledge and proper systems to minimise the effect. It will be a very interesting and valuable webinar for landlords to listen in to.

If you would like to sign up, please click the following registration link;

Register in advance for this webinar:

https://us02web.zoom.us/webinar/register/WN_ceB9ZR_bRMyRuq5L7tFa6w

The webinar is limited to 500 attendees on a first come, first served basis.

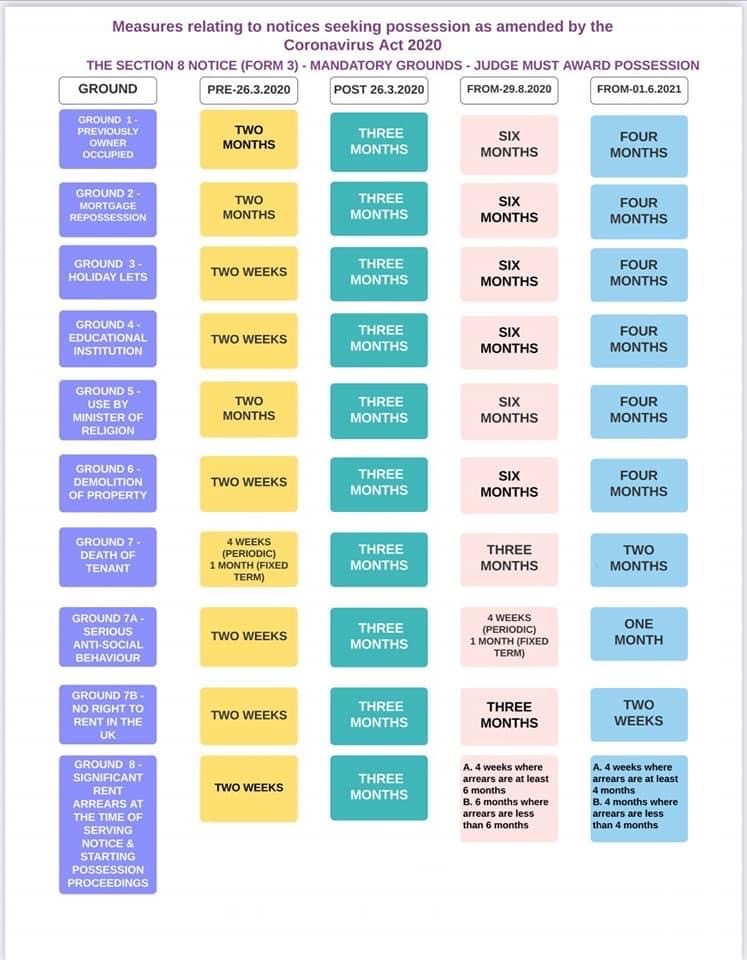

On 01 June 2021, possession forms were updated on the government website to reflect the new 4 minimum month notice periods for Section 8 notices and Section 21 notices.

The possession forms on the SWLA database were updated at 12 noon on 03 June 2021, if you printed possession forms prior to that time, please log back in and print again to ensure that you serve the correct notice to your tenant.

If you served your tenant notice anytime after 4.30pm on Friday 28th May 2021, the new form will need to have been used.

Remember to give a few days extra on your notice periods. If you give exactly 4 months, it can be thrown out of court to not giving enough notice to your tenant.

The Home Office has extended the period in which landlords in England can carry out Right to Rent checks by video call by a further month to 20 June 2021.

In April 2021, the UK Government declared that Adjusted Checks carried out with applicants submitting scanned or photographed documents, would end on 16 May 2021. This date has now been pushed back, aligning it with other measures to ease restrictions in England. This revision allows an extra month of virtual checks.

The Home Office has dropped plans for all ‘Covid adjusted’ checks carried out since 20 March 2020, to be repeated with full in-person checks within eight weeks of temporary arrangements ending. Therefore, please note, if you did a virtual check during the Covid period, you do NOT need to carry out a repeated check in person when the measured end.

From 21 June 2021, all landlords will need to revert to in-person Right to Rent Checks in accord with the Code of Practice. The only exception to this will be applicants with a Home Office status who offer a digital share code.

For any Right to Rent queries, visit the gov.uk website or call the landlord helpline on 0300 790 6268.

https://www.gov.uk/guidance/coronavirus-covid-19-landlord-right-to-rent-checks

Tenants with disabilities struggle to find suitable homes. SWLA are supporting a new initiative to encourage landlords to consider adapting their properties.

NRLA released a report ‘Adapting the Private Rented Sector’ which exposes a chronic lack of accessible properties for disabled tenants. Four in five wheelchair users in the Private Rented Sector are living in a home that fails to meet their needs, and 91% have experienced barriers to renting.

According to recent research conducted by the Social Market Foundation, the number of private rented sector (PRS) households headed by a person 65 years or older is set to double by 2046. With this in mind the we believe that now is the time for local authorities and landlords to work together to address this ongoing issue. Taking this important step will help expand the number of adapted homes for UK disabled and older renters, ensuring an inclusive PRS which works for all.

Key to addressing these issues is clearer communication from local authorities to landlords concerning the availability of the Disabled Facilities Grant (DFG), available through local authorities. NRLA research suggests that 79% of landlords had no knowledge of the grants. After finding out more, 68% of landlords were more willing to adapt their properties.

This is a chance for local governments to take a lead on an increasingly important issue by taking practical action now, before the UK’s adaptation challenges become even more acute.

New guidance has been released ‘Adaptations: Good Practice Guidance’ setting out how private landlords can consider requests for adaptations to make their properties more inclusive and accessible.

The simple and fair answer would be no. Head of the ARLA Propertymark Legal Helpline gives reasons here;

“The answer may be “no”. There is a concept in English law which suggests that if a landlord does something – for example serves a notice – and the tenant relies on that to his detriment, then the landlord cannot change his position. The principle is called estoppel.

“It could apply where a tenant received a 6 month notice, made arrangements to view other properties appropriate to that Notice and incurred expenses as a result. If a second Section 21 notice expired before the original 6 month deadline, a tenant could argue that the second notice was effectively invalid.

“Please make sure landlords are aware of the potential risk before serving a second Section 21 Notice if an earlier Notice is still current.”

To be fair to tenants, existing notice periods should be honoured.

Information from the NRLA

**PLEASE NOTE – THIS IS NOT AN SWLA WEBINAR – PLEASE SIGN UP BY CLICKING THE LINK BELOW IF YOU WISH TO ATTEND**

Martyn Taylor of Ashley Taylors Legal invites all SWLA members to the following free landlord webinar;

When – 11am Thursday 20th May 2021

Subject- Strengthening Your Tenancy Agreements

Where- Zoom

Martyn will be looking at both ASTs and Company Lets in this talk and considering the “must haves”, ” good ideas to have” and also “should nots” in your Agreements; to benefit the Landlord and potentially troubleshoot in advance for when things go wrong.

If you would like to sign up, please click the following registration link;

Register in advance for this webinar:

https://us02web.zoom.us/webinar/register/WN_nFhp7cApRrCA5kmr-KEVGQ

The webinar is limited to 500 attendees on a first come, first served basis.

The government has announced that from 01 June 2021 notice periods in England that are currently six months, will now be reduced to four months.

The following reasons for eviction (via Section 8) will have these notice periods from 01 June 2021;

Notice periods for cases where there is less than four months’ unpaid rent, will reduce to two months’ notice from 01 August 2021.

Subject to Public Health advice notice periods will return to pre-pandemic levels from 01 October 2021.

Financial Support for Tenants

Renters will continue to be supported with living costs, including rent, through the Coronavirus Job Retention Scheme until 30 September 2021.

Financial support remains in place to help people meet their outgoings, including the furlough scheme and the Universal Credit uplift, which have both been extended until the end of September 2021.

The current ban on bailiff-enforced evictions, introduced as an emergency measure during lockdown, will end on 31 May. Bailiffs have been asked not to carry out an eviction if anyone living in the property has COVID-19 symptoms or is self-isolating.

The government have pledged to bring The Renters Reform Bill to Parliament. The Bill is likely to include the scrapping of Section 21 ‘no fault’ evictions, the introduction of lifetime deposits and the introduction of a landlord ombudsman

A white paper is due out later this year which will outline government policy and future changes in the Private Rented Sector.

It is expected that new rules will not come into force until Spring 2023.

It has been brought to our attention by SWLA members that following an Electrical Safety Inspection, some electricians are stating on EICRs that the next Electrical Safety Inspection is due in ‘5 years or change of occupancy.’ This has been causing concern and confusion for landlords as the regulations talk about ‘regular intervals’, not events such as a change of tenancy.

In particular, reg 3(2) says:

(2) For the purposes of sub-paragraph (1)(b) “at regular intervals” means—

(a) at intervals of no more than 5 years; or

(b) where the most recent report under sub-paragraph (3)(a) requires such inspection and testing to be at intervals of less than 5 years, at the intervals specified in that report.

Landlords are well aware that between tenants, the electrics are to be visually checked (by landlords if they are competent) to ensure that the property is safe for the new tenant moving in. That along with providing an in date EICR would be sufficient for a landlord to know that the electrical condition of the property is good and that legislative duties have been met. **If any tampering evidence is noticed, or any over use/high turnover of tenants, the landlord should instruct a new Electrical Safety Inspection.**

We have written to Local Authorities, The Ministry of Housing Communities and Local Government, PRS training providers and NICEIC.

The outcome being that a landlord does NOT need to obtain a new EICR upon a change of tenant despite what the certificate says. ‘Change of tenant’ is not an interval.

If any of our members need guidance on this, feel free to call the SWLA office and we will be glad to help.

You Are Invited to the 2021 Bristol City Council Online Landlord & Agent Forum

When – Thursday 13th May 2021 4pm – 5.45pm

Subject – What’s Next For The Private Rented Sector? With Q&A

Guest Speaker – Meera Chindooroy, NRLA

In addition to our guest speaker, there will be presentations from Bristol City Council on working with landlords in the Private Rented Sector to reduce homelessness; fill empty properties as well an update on Universal Credit from the Department for Works and Pensions.

There will be an opportunity to put questions to all the speakers.

Meera is Deputy Director of Campaigns, Public Affairs & Policy at the NRLA. She joined the National Landlords Association (NLA) in May 2018, having previously worked in both policy development and project management for a range of not-for profit and public sector organisations including the Big Lottery Fund and the General Medical Fund.

If you are interested in attending, email: private.landlords@bristol.gov.uk and type into the

subject header: “Register me for the Bristol City Council Landlord & Agent Forum”

Please share this invitation with anyone who may be interested.

You will be sent a link to join prior to Thursday 13 May 2021

The Debt Respite Scheme (Breathing Space) came into force on 4 May 2021. The creditor service is currently being developed.

The Debt Respite Scheme (Breathing Space) will give someone in problem debt the right to legal protections from their creditors.

There are two types of breathing space: a standard breathing space and a mental health crisis breathing space. Where there is a difference between them, we’ll refer specifically to either a standard breathing space or a mental health crisis breathing space. Where there is no difference, we will simply refer to a breathing space.

A standard breathing space is available to anyone with problem debt. It gives them legal protections from creditor action for up to 60 days. The protections include pausing most enforcement action and contact from creditors and freezing most interest and charges on their debts.

A mental health crisis breathing space is only available to someone who is receiving mental health crisis treatment and it has some stronger protections. It lasts as long as the person’s mental health crisis treatment, plus 30 days (no matter how long the crisis treatment lasts).

The legislation this guidance references is The Debt Respite Scheme (Breathing Space Moratorium and Mental Health Crisis Moratorium) (England and Wales) Regulations 2020. This guidance is intended to support creditors in understanding the regulations.

As a creditor, if you’re told that a debt owed to you is in a breathing space, you must stop all action related to that debt and apply the protections. These protections must stay in place until the breathing space ends.

The electronic service will send you a notification to tell you about each debt owed to you in a breathing space and the date the breathing space started. You need to make sure you apply the protections to these debts from the date set out in the notification.

If you’re a creditor, it’s also possible your debt might be added to a breathing space at a later date, because it is only identified after the breathing space has started. In this case, you have to apply the protections from the date you get the notification, or when the regulations consider you to have received it, whichever is the earliest.

For electronic notifications this is the date they are sent. For postal notifications this is 4 working days after it was posted.

If you have any questions about a breathing space you’ve had a notification for, you should contact the debt advice provider whose details are in the notification.

Debts included in a breathing space must be qualifying debts. Debts are any sum of money owed by the debtor to you, while liabilities are any obligation on the debtor to pay money to you. Most debts are likely to be qualifying debts. These will include:

Qualifying debts can include any that the debtor had before the Breathing Space legislation came into force on 4 May 2021.

New debts incurred during a breathing space are not qualifying debts. Neither are new arrears on a secured debt that arises during a breathing space.

For full information please see; https://www.gov.uk/government/publications/debt-respite-scheme-breathing-space-guidance/debt-respite-scheme-breathing-space-guidance-for-creditors

Martyn Taylor will be looking at both ASTs and Company Lets in this talk and considering the “must haves”, ” good ideas to have” and also “should nots” in your Agreements to benefit the Landlord and potentially troubleshoot in advance for when things go wrong.

The registration details are:

When: May 20, 2021 11:00 AM London

Topic: Strengthening your Tenancy Agreements

Register in advance for this webinar:

https://us02web.zoom.us/webinar/register/WN_nFhp7cApRrCA5kmr-KEVGQ

Please note, numbers are limited to 500, sign up now to avoid missing out. This is not an SWLA webinar, it is hosted by Ashley Taylors Legal.

The Section 8, Form 3 has been updated to reflect the coming into force of breathing space (debt respite scheme) regulations, which affect the ability to serve notice and make a possession claim under Section 8 of the Housing Act 1988 in certain circumstances.

Please obtain Section 8 and Section 21 forms from the SWLA website members area or online at gov.uk to ensure that you are using the most up to date version.

Wednesday 23rd June 2021 – 11am – 12:30pm

& Repeated at 7pm – 8:30pm

We are holding two FREE training webinars being presented by Stephen Fowler.

The webinar will cover the topic – HHSRS (Housing Health and Safety Rating System) and Fitness for Human Habitation.

If you would like to register for either of these sessions, please contact the office to book your place stating which you wish to attend.

Once you have registered, we will email you details regarding joining the webinar.

Thank you to Stephen Fowler for a brilliant webinar on Wednesday 28th April. Landlord Compliance was covered in depth and lots of recent, new legislation was discussed. We had over 60 members join us with some great queries and points raised.

We look forward to our next training webinars on Wednesday 23rd June – 11am and repeated at 7pm (HHSRS and Fitness for Human Habitation) – contact the office to book your place!

We continue to host our meetings online whilst Covid restrictions are in place. Not as nice as meeting in person at the Future Inn, but we look forward to those times again.

Thank you to all members who joined our meeting and thanks to our very informative speakers Martyn Taylor ( www.ashleytaylors.co.uk ) and Annette Stone ( www.thomaswestcott.co.uk ). Martyn and Annette are happy to accept questions via email, feel free to email the SWLA office and we will forward on for you.

If any of our members missed the meeting, we have Martyn’s lecture on The Debt Respite Scheme and Annette’s presentation on Tax Legislation Affecting Landlords. We are happy to send these by email upon request.

Take care, from the SWLA staff and Committee.

The Electrical Safety Standards in the Private Rented Sector (England) Regulations 2020

These Regulations apply in England to –

What do the Electrical Safety Standards in the Private Rented Sector (England) Regulations 2020 require?

Landlords of privately rented accommodation must:

Please click here for the full NAPIT landlord guide; https://www.napit.org.uk/downloads/Electrical-Safety-in-the-Private-Rented-Sector-Regulations-Guidance-for-Landlords-NAPIT.pdf

And the full gov.uk guide; https://www.gov.uk/government/publications/electrical-safety-standards-in-the-private-rented-sector-guidance-for-landlords-tenants-and-local-authorities/guide-for-landlords-electrical-safety-standards-in-the-private-rented-sector

If you need an electrician, you can find one on the SWLA website trade directory https://www.landlordssouthwest.co.uk/tradelistings/electricians-pat-electrical-services/ or search the following; www.electricalcompetentperson.co.uk www.search.napit.org.uk

Letting and property agents in England must belong to a client money protection scheme by 01 April 2021, when the two-year grace period comes to an end.

It has been mandatory for letting agents in England who hold client money to belong to a client money protection scheme since 1st April 2019.

Letting agencies can be fined up to £30,000, if they do not belong to an approved client money protection scheme, and up to £5,000, if they don’t display their certificate of membership or provide it when asked.

Client money protection schemes protect landlords’ and tenants’ money in the event of theft or misappropriation by agents and ensure that they are compensated. Client money protection also protects landlords’ and tenants’ money should an agency experience financial difficulties – if it was to go into administration, for example.

There are currently six government-approved client money protection schemes – Client Money Protect, Money Shield, Propertymark, RICS, Safeagent (previously NALS), and UKALA Client Money Protection. In order to join a client money protection scheme, agencies will need to hold their clients’ money in an account with a bank or building society authorised by the Financial Conduct Authority. Agencies are also expected to have strong client money handling procedures in place.

Agencies will need to display the certificate confirming their membership of an approved client money protection scheme in a visible location in each of their premises and on their website. It’s also recommended that they publish a copy of their membership certificates on third-party websites and alongside listings on portals. Agents must provide a copy of the certificate from their approved scheme to anyone who reasonably requests it, free of charge.

Article from https://blog.goodlord.co/letting-agents-must-comply-with-client-money-protection-legislation-by-1-april-2021

Topic – Landlord Tax Topics: Limited companies or not? What valid expenses can you claim on your tax return? and more!

They will cover the following topics:

To sign up, please visit the Mashroom site – Valid and invalid expenses that you can claim on your tax return – Free Webinar (mashroom.com)

**Please note, this is a 3rd party webinar, not hosted by SWLA**

Following a review, the Green Homes Grant Voucher Scheme launched last year will close to new applications on 31 March at 5pm. Applications made before the end of March deadline will be honoured and any vouchers already issued may be extended upon request.

The Green Homes Grant (GHG) reached just 10% of the 600,000 homes the chancellor promised would be improved.

The scheme will be stopped and the cash allocated to a separate insulation fund run by councils.

The £300m previously allocated for the GHG will now go into a programme administered by local authorities, targeted at lower income households.

Some 19 million homes in the UK need to be insulated or the emissions from gas boilers will wreck the UK’s chances of achieving its climate change targets.

But the GHG scheme, which launched in September in a bid to tackle that, has struggled from the start.

The government said many households were reluctant to apply for the grants – up to £10,000 – because they feared catching Covid from contractors coming into their homes.

However, in some parts of the country installers were actually overwhelmed with demand, and families could not even get firms to answer the phone.

Then checks on the way the money was spent were so stringent that some installers went out of business because payments were so badly delayed.

And despite the checks, some builders appear to have hugely overcharged for their work. One joiner told me he had witnessed an installer carry out work worth £3,000 at most, then deliver an invoice for £5,000.

It seems clear there is frustration in Whitehall at the American consultants brought in to manage the scheme for able-to-pay families.

The parallel insulation scheme administered by local authorities is running much more smoothly but ministers still need to create a new programme to nudge able-to-pay home owners into improving their insulation for the UK to hit its climate change targets.

There is no sign yet what that new programme might look like, or when it might happen.

A government source pointed out that the Conservatives promised in their manifesto to spend £9bn on insulation – and insisted that this cash would definitely be made available.

Campaigners, industry figures, and MPs said the current scheme was botched and called for the Chancellor Rishi Sunak to create an insulation programme stretching for decades, so that installers and suppliers have the chance to build up stocks and expertise.

Previously many firms have been driven out of the sector following stop-start government funding.

On announcing the move, Energy Secretary Kwasi Kwarteng chose to focus on the transfer of cash to the local authority fund, rather than the scrapping of the GHG.

He said: “Upgrading the country’s homes with energy efficiency measures means we can cut emissions and save people money on their energy bills.

“Today’s funding boost will mean even more households across England are able to access these vital grants through their local authority.

“This latest announcement takes our total energy efficiency spending to over £1.3bn in the next financial year, giving installers the certainty they need to plan ahead, create new jobs and train the next generation of builders, plumbers and tradespeople.”

Article from BBC News; https://www.bbc.co.uk/news/science-environment-56552484