After the Government’s ‘Tax Day’ on Tuesday 23rd March, Landlords have been warned that there may be a surprising change buried in the announcements relating to the Making Tax Digital programme.

For the most part, the announcements made on ‘Tax Day’ had little impact on the property sector. Property developers and investors looking for some beneficial change were underwhelmed. However, Katharine Arthur, a tax expert at accountancy practice HaysMacIntyre, has suggested that there is a hidden surprise for landlords from the announcements.

She states: “of particular note is the confirmation that Making Tax Digital for income tax is set to go ahead in April 2023, as it will fundamentally change how those receiving rental or self-employed income, for example, file their tax returns. This, in turn, ties in with the proposed changes to timely payments, which could see those who pay through tax returns reporting quarterly or even monthly, as opposed to two instalments a year.”

Katharine Arthur continues: “these changes could result in a significant overhaul of the tax system as we know it, and although it could see both the self-employed and landlords facing a hefty administrative task as they get to grips with the new reporting methods, it will ultimately help to streamline and modernise the current system.”

This is surprising and interesting news for potential property investors and wannabe-landlords who may have been holding back due to the fear of tax returns. Having to always keep up with their tax to file two large payments per year can be a daunting task, as many fear a miscalculation could mean they spend money meant for their tax returns. By having the potential for more manageable digital tax payments and more payment opportunities quarterly or monthly, the risk of not calculating tax correctly is reduced.

However, the government also made another shocking announcement for property investors on ‘Tax Day’. They suggested tightening taxation around holiday lets. Taxes are more favourable to holiday lets than buy to let, and if your home meets the holiday let criteria, it can save you some real money as you become classed as a business. However, the government included the following statement in their announcements, suggesting a change in this area:

“The government will legislate to change the criteria determining whether a holiday let is valued for business rate to account for actual days the property was rented, following a previous consultation. This will ensure that property owners cannot reduce their tax liability by declaring that a property is available for let while making little or no actual effort to do so. Further details of the change and implementation will be included in the Ministry for Housing, Communities and Local Government’s response to the consultation on the business rates treatment of self-catering accommodation which will be published shortly.”

Property investors and landlords who have dealings with holiday homes – or were considering this route – need to seriously consider whether this is a profitable and viable option anymore with these proposed changes.

Article by The Property Forum

Landlords Warned Tax Change Could Have Shocking Impact – Investment Property Forum

Halls v Houses – key trends in student accommodation

Apr 21, 2021 2:00 PM

To register please click here; Webinar Registration – Zoom

The webinar, hosted by ‘Accomodation for Students’ to discuss the latest student accommodation trends.

They will use the session to present the results of a major study into student accommodation choices and decision making. There will be a particular focus on what students perceive as being the differences between HMO’s and purpose built student accommodation.

The session will last approximately one hour and be hosted by the MD of AFS Simon Thompson and presented by Nick Emms. Simon and Nick will be joined by a small team of students for a brief panel discussion.

We are launching a 10-week consultation on plans to introduce licensing requirements to certain properties in Brislington West, Bedminster and Horfield to improve housing standards.

The Housing Act 2004 allows local authorities to require landlords of some privately rented accommodation to license their properties. Licensing can be applied to specific areas of the city where evidence suggests there is poor quality private rented housing.

Following the success of the licensing schemes in Stapleton Road, Easton and in St George West, Eastville and 12 wards in the centre of the city, the council is looking to further improve both the accommodation, conditions and management practices in privately rented and multiple occupied properties in these three wards.

Licensing places conditions on the landlord/agent to ensure that minimum property standards are met and that good management practice is delivered. Advice and guidance on the necessary improvements required to ensure the property complies with licensing conditions is also offered. Where landlords do not meet the required condition standards, enforcement action may follow.

The proposed scheme covers two types of licensing:

The proposal is that:

• Horfield ward is declared an Additional licensing area

• Bedminster ward is declared a joint Additional and Selective Licensing area

• Brislington West ward is declared a joint Additional and Selective Licensing area

If the licensing goes ahead, landlords will be charged a fee for licensing their properties. A licence will normally last for five years and conditions would be attached to the licence to improve management practices and standards.

What are we asking people to do?

We want local residents, tenants and landlords in these areas to tell us what they think.

People can find out more and have their say by filling in a survey available online at www.bristol.gov.uk/propertylicensing2021

Alternative formats or paper copies of the information can be requested by calling 0117 9222474 and leaving contact details.

The consultation closes on 26 May 2021.

Please complete the HHSRS review survey by the deadline of 31st March 2021 if you wish to have a say.

More information can be read on the following link; https://www.rheglobal.com/news

And here is the link to the landlord survey https://www.surveymonkey.co.uk/r/CRX2TTD

Wednesday 2nd June 2021 – 9:00 – 4:30pm

Venue – Online

Price – £65 for members of SWLA, £75 for non – members for one day course.

Course covers ASTs, Deposits, Section 21s, Section 8s, HMOs, Gas and Electrical Safety, Inventories and much more.

The course will provide you with all the skills to start, manage and finish a tenancy.

Places still available. Contact the office on 01752 510913 or info@landlordssouthwest.co.uk to book your place, places only secured on receipt of payment.

Over 950 landlords have already completed this course since September 2011.

Course can lead to Accreditation, if required.

We are proud to announce Landlord Accreditation South West (LASW) are founder members of the West of England Rental Standard.

Both the ban on using bailiffs, and the longer notice periods for Section 21 and 8 will continue in the same way until at least 31 May 2021.

The UK Government outlined that measures will be kept under review in line with the latest public health advice. We will advise members as soon as new information is released by the government.

The UK Government will consider the best approach to move away from emergency protections from the beginning of June, taking into account public health advice and the wider roadmap.

Until the 31 May 2021, private landlords will need to continue to give tenants six months notice before they can repossess properties, except in the following circumstances:

GROUND NOTICE PERIOD

| 7: Death of tenant | 3 months |

| 7a: Serious anti-social behaviour | 4 weeks (periodic tenancy) 1 month (fixed term tenancy) |

| 7b: No right to rent in the UK | 3 months |

| 8: Serious rent arrears at time of service of notice and possession proceedings | (a) 4 weeks where arrears are at least 6 months (b) 6 months where arrears are less than 6 months |

| 14: Nuisance/annoyance, illegal/immoral use of property | None – proceedings may be commenced immediately after service of notice, minimum 24 hours recommended. |

For all notice periods see; https://www.gov.uk/government/publications/covid-19-and-renting-guidance-for-landlords-tenants-and-local-authorities/technical-guidance-on-eviction-notices

The courts remain open and landlords can get a possession order through the courts.

However, possession orders can only be enforced by a bailiff after 31 May 2021.

Landlords can currently only enforce a possession order via a bailiff where:

For any other situation (such as a possession order based on a Section 21 notice), landlords will have to wait until after 31 May 2021 for a bailiff to attend the property.

Wednesday 24th March 2021 – 11am – 12:30pm

& Repeated at 7pm – 8:30pm

We are holding two FREE training webinars being presented by Stephen Fowler.

The webinar will cover the topic – New Possession Rules.

If you would like to register for either of these sessions, please contact the office to book your place stating which you wish to attend.

Once you have registered, we will email you details regarding joining the webinar.

The LHA rates from 1st April 2021 have been determined in accordance with The Rent Officers (Housing Benefit and Universal Credit Functions) (Modification) Order 2020 (SI 2020/ 1519) and are the same rates that came into force on 1st April 2020. These rates will not appear on LHA-Direct before 15 March 2020.

Local Housing Allowance (LHA) rates applicable from April 2021 to March 2022 – GOV.UK (www.gov.uk)

Changes that may impact landlords;

Unfortunately, the Government did not announce measures to tackle Covid-related rent debt.

https://www.gov.uk/government/publications/budget-2021-documents

Key points at a glance;

Information from BBC; https://www.bbc.co.uk/news/uk-politics-56266773

https://www.gov.uk/government/news/housing-secretary-extends-support-for-renters-during-pandemic

Renters will continue to be supported during the ongoing national lockdown restrictions, with an extension to the ban on bailiff evictions, Housing Secretary Robert Jenrick announced today (14 February 2021).

The ban on bailiff evictions – which was introduced at the start of the pandemic – has been extended for another 6 weeks – until 31 March – with measures kept under review in line with the latest public health advice.

Exemptions remain in place for the most serious circumstances that cause the greatest strain on landlords as well as other residents and neighbours, such as illegal occupation, anti-social behaviour and arrears of 6 months’ rent or more.

The measures are part of a wide-ranging package of support the government has provided to protect renters from the economic impact of the pandemic, including supporting businesses to pay staff through the furlough scheme and strengthening the welfare safety-net by billions of pounds.

Landlords are also required to give 6-month notice periods to tenants before starting possession proceedings, except in the most serious circumstances, meaning that most renters now served notice can stay in their homes until at least August 2021, with time to find alternative support or accommodation.

For those renters who require additional support, there is an existing £180 million of government funding for Discretionary Housing Payments for councils to distribute to support renters with housing costs.

Housing Secretary, Rt Hon Robert Jenrick MP said:

We have taken unprecedented action to support renters during the pandemic including introducing a six-month notice period and financial support to help those struggling to pay their rent.

By extending the ban on the enforcement of evictions by bailiffs, in all but the most serious cases, we are ensuring renters remain protected during this difficult time.

Our measures strike the right balance between protecting tenants and enabling landlords to exercise their right to justice.

Court rules and procedures introduced in September to support both tenants and landlords will remain in place and regularly reviewed, with courts continuing to prioritise the most cases, such as those involving anti-social behaviour, illegal occupation and perpetrators of domestic abuse in the social sector.

The government has also launched a new free mediation pilot to support landlords and tenants to resolve disputes before a formal court hearing takes place. This will help tenants at an early stage of the possession process, mitigating the risk of tenants becoming homeless and helping to sustain tenancies where possible.

Together these measures strike the right balance between prioritising public health and supporting the most vulnerable renters, whilst ensuring landlords can access and exercise their right to justice in the most serious cases.

The package of support is reducing the number of evictions as applications to the courts for possession by private and social landlords were down 67% between October and December 2020, compared to the same quarter in 2019. The number of repossessions recorded October to December 2020 was down 93% compared to the same quarter in 2019. Only 548 repossessions were recorded between April and December 2020 compared to 22,444 in the same period in 2019.

The government previously changed the law in England to ensure bailiffs do not enforce evictions for 6 weeks until 22 February. This has now been extended for a further 6 weeks until 31 March. This will be kept under review.

The only exceptions to this are for the most egregious cases – anti-social behaviour, illegal occupation, death of a tenant where the property is unoccupied, fraud, perpetrators of domestic abuse in social housing and rent arrears equivalent to at least 6 months’ rent.

Guidance to support landlords and tenants in the social and private rented sectors understand the possession action process and new rules within the court system in England and Wales is available.

The Accreditation Course is a one day course and we have booked 2 dates to accommodate the demand and are hoping to secure more dates shortly.

Monday 22nd February 2021 – 9am – 4:30pm.

Price – £65 for members of SWLA, £75 for non-members for the one day course.

~

Monday 22nd March 2021 – 9am – 4:30pm.

Price – £65 for members of SWLA, £75 for non-members for the one day course.

~

If you would like to book a place on either of the courses, please email or call the office on info@landlordssouthwest.co.uk or 01752 510913.

Your place will only be secured once payment has been received, you can pay by BACS, Cheque or call and pay by Credit/Debit Card

How to pay-

Account Name: SWLA

Sort Code: 20-68-10

Account Number: 50498610

Please quote your name as the reference

Or by Cheque to:

SWLA, 30 Dale Road, Plymouth, PL4 6PD

If you have any queries, please do not hesitate to call us.

Information from Plymouth City Council

Plymouth City Council has announced details about new discretionary funding available to support businesses that are severely impacted by the third national lockdown.

The city has been allocated a total of £7.57 million to support local businesses through the Additional Restrictions Grant (ARG). More than £1.7 million has already been distributed to help businesses that struggled during the November lockdown.

The discretionary funding is intended to support businesses that cannot claim from the Local Restrictions Support Grant (LRSG) scheme, which gives grants to rate-paying businesses that have been forced to close due to the national restrictions.

Businesses may be eligible to apply for financial support through the ARG if they:

Due to the limited amount of funding available, the Council will prioritise the following types of businesses when distributing the grants:

The Council is prioritising in order to help as many businesses as possible, however it is likely that the Government funding may not meet the demands for help.

Applications for the new ARG will open at 10am on Monday 1 February. Businesses must complete a new application, even if they have received a discretionary grant during previous lockdowns.

In order to apply for a grant, businesses will need to meet the following criteria:

Businesses will not be eligible for funding if they have exceeded state subsidy limits or are in administration, insolvent or where a striking off order has been made. Certain types of businesses will also not be considered eligible, including ‘home sharing’ businesses, buy to let properties and premises that are used for personal use only (for example, riding stables).

Grant payments

The grants awarded are one-off payments intended to support businesses through the third national lockdown which started on 5 January 2021.

Businesses that do not pay rates will be eligible for a grant of £3,000.

Rate-paying businesses that have not been forced to close but are still significantly affected can claim the following grants:

Only one discretionary grant will be awarded to any business per lockdown, but if businesses operate from multiple Plymouth premises they may be eligible for additional payments.

The grants are intended to help with fixed business costs rather than to replace lost income, as there are other schemes offering this financial support. More information about these schemes can be found on the Invest Plymouth coronavirus business support page, or via the Heart of the South West Growth Hub.

A portion of the overall funding given to the Council will also be allocated to supporting wider economic development activity across the city and key city institutions that provide a significant economic benefit.

For more information about the ARG and LRSG grant schemes, including how to apply, please see: investplymouth.co.uk/business-grants.

Article by Community Energy Plus. For more information please contact Nicole Solomons on 01872 308930 or email: nicole@cep.org.uk

Introducing a new service from Community Energy Plus, designed to provide advice, support and guidance to private sector landlords working alongside their tenants. The aim of the Warmer Tenants Advice Service is to improve the energy efficiency of rented properties in Cornwall. Here, the advice team have put together a few Q&As to explain what the service aims to do and how they can help.

With so much information on various standards, rating systems, regulations and statutory obligations, it’s not surprising that many landlords feel confused and overwhelmed. We’re here to help landlords through the maze, find cost-effective ways to improve and maintain their property and to help landlords ensure their tenants are living in warm and healthy homes.

There’s so much information out there, I’m completely confused and just don’t have time to deal with it.

We understand. Our professionally trained advisors can help guide you through the maze of information and assist you with anything you don’t understand or need help with in improving the energy performance of your property. A problem shared, is a problem halved, as they say. The most difficult part of the process is deciding to do something about it.

I have asked for advice before – how are you different?

We’re a new service, helping to liaise between landlords and their tenants. We have a dedicated Landlords & Tenants Advisor who can help make the process much easier and by using our advice service, landlords can be assured of free and impartial advice to help them find solutions and available options in order to make cost-effective, energy efficient improvements to their property. Part of our service is to provide an advocacy service, speaking with both landlord and tenant to ensure the best outcome. This can be a combination of property visits and/or phone calls. We can liaise with tenants and other third parties, if appropriate, in order to secure grant funding. Landlords can be confident that not only can they meet regulations, but also secure existing and prospective tenancies by ensuring their tenants live in warmer homes.

Do you provide EPCs?

We do provide EPCs where a new EPC is needed as part of the process. In addition, we can also provide EPC modelling, which is a way of producing draft EPCs that show a selection of measures to increase your property’s EPC rating, so you can prioritise what to do and potential costs and savings.

I need to raise my property’s EPC rating to an E. How am I going to be able to afford this?

Part of the advice service is to help landlords gain access to grants in order to help pay for measures needed. For example, if you have an eligible tenant, we can help you access ECO grants, and we can give advice on the new Green Homes Grant which landlords are eligible to apply for. There is a maximum price cap that landlords have to spend on improving a property and if this is met, an exemption can then be applied for. There are other instances where exemptions can be applied for and we will be happy to advise on this process.

I have heard the minimum EPC rating may be raised to a C in a few years’ time. Is this true?

BEIS (the Department for Business, Energy and Industrial Strategy) has just completed a consultation on whether to increase the minimum EPC rating to a C from 2025 for new tenancies and from 2028 for existing tenancies. If your property’s EPC rating is already D or E, then we can help you find ways to make the investment to move toward a low-carbon property, thus future-proofing your property to any new regulations.

Apart from meeting regulations, what’s the point of improving my property’s EPC rating?

Existing tenants should save money on their energy bills, which in turn could make them a more secure tenant with less chance of running into rent arrears. For prospective tenants, your property should look more attractive, as tenants would expect lower energy bills and a warm home in which to live.

Are there any special provisions for listed buildings or property in conservation areas?

There is no blanket exemption for historic buildings, listed buildings or buildings within a conservation area from requiring an EPC and in the majority of cases an EPC will be required. Protected buildings will only be exempt if compliance with the minimum energy efficiency requirements would unacceptably alter their character or appearance and the owner can provide evidence of this. Even if a building is protected it is likely that it may still be possible to make some improvements without altering its character or appearance and advice should be sought to confirm this. The

onus is on the owner of the property to understand which works may or may not be permitted. A property owner can contact the Planning Service at Cornwall Council to provide evidence in relation to the likelihood of obtaining planning permission or listed building consent for energy efficiency improvements through the Planning Service page.

Where can you get additional information?

For more information from Community Energy Plus: https://www.cep.org.uk/ourservices/warmer-tenants-advice-service-for-landlords/

Community Energy Plus

35 River Street

Truro

Cornwall

TR1 2SJ

Telephone

01872 245566 / 0800 954 1956

Freephone advice line

0800 954 1956

Email

advice@cep.org.uk

An update on business grants by Plymouth City Council.

Updated 21 January 2021

Plymouth City Council can confirm that the first tranche of businesses will have received an email on Thursday 21 January providing details of their automatic grant payment.

We have identified a number of businesses who we believe to be eligible, but require additional checks before automated payment can be confirmed.

If you received a November lockdown LRSG grant for your business, and do not receive an email from Plymouth City Council, we hope to be in touch with you within the next working week to check or confirm details with you.

Tier 3 and Lockdown Business Grants

Updated 19 January 2021

Plymouth City Council has been given a further £20.3 million to distribute in grants to support businesses during the third national lockdown.

We are working hard to get this money out as quickly as possible and to make the process simple for businesses.

Grants are currently available for businesses that pay business rates and are legally required to close during Tier 3 and the national lockdown. If you do not meet these requirements you may be eligible for discretionary funding and more information about this will be available soon.

If you have already applied for the November lockdown grant (Local Restrictions Grant Scheme (LRSG) Closed), you do not need to reapply. You should receive a confirmation email from Plymouth City Council detailing the amount of your grant payment, the scheme that your grant is from and the expected payment date.

We have received applications from approximately 60 per cent of eligible businesses, which means around 40 per cent of eligible Plymouth businesses have not applied. If you haven’t already, we would urge you to complete an application as soon as possible. Please note that we are only able to automatically pay those who successfully applied for the second November lockdown grant. This does not include businesses that received grants during the first national lockdown if they have not applied for the second lockdown funding.

If you have not applied for the November lockdown grant, you will need to complete an application form on the Council website. You will then receive all the funding you are eligible for.

Tier 3:

Plymouth was in Tier 3 for five days, from 31 December to 4 January, and eligible businesses are entitled to a pro-rata grant payment for this period.

Lockdown business grants:

Plymouth, along with the rest of the country, entered a national lockdown on 5 January 2021. Businesses required to close and which pay business rates are eligible for the following financial support:

Local Restrictions Grant Scheme (Closed) addendum:

Eligible businesses required to close due to the national lockdown will be entitled to receive the following grants to cover the entire 42 day initial lockdown period (5 January to 15 February):

Closed Business Lockdown Payment:

This is a one-off payment for eligible rate paying businesses that have been required to close by the Government. Payments are calculated based on rateable value:

Additional Restrictions Grant:

If you are not eligible for the above schemes, you may be entitled to discretionary funding.

Applications for the Additional Restrictions Grant covering the November lockdown closed Thursday 21 January and all existing applications will be processed.

A new discretionary scheme will be launched in the coming weeks, with updated eligibility criteria, and we will share more details as soon as possible.

For businesses who haven’t previously applied for grant support:

If you pay business rates and were legally required to close during the November lockdown but have not yet applied for your November grant, you will not receive automatic payment of the new grants.

Please complete the application form on the Plymouth City Council website as soon as possible.

Applications for the LRSG Closed and Closed Business Lockdown Payment scheme will close on 31 March 2021, with final payments being made by 30 April 2021.

If you believe you are eligible and have applied for a November LRSG grant but do not receive an email from Plymouth City Council by Friday 29 January to confirm an automatic payment, please email business.grants@plymouth.gov.uk or call the helpline on 01752 308984 which will be open Monday to Friday, 9am to 5pm.

Please note, all the information found on the page below is about grants for businesses that pay rates directly to Plymouth City Council and which are legally required to close during tiered restrictions and the current national lockdown.

If this criteria does not apply to you, you may be eligible for discretionary funding through the Additional Restrictions Grant and more information will be available in the coming weeks.

Visit the FAQs for rate-paying businesses page.

For business grant information from other local authorities, please check their websites for further information.

The Government is failing to tackle the Covid rent debt crisis.

Following the announcement of a 6 week extension on the eviction ban in England until 21st February 2021, there has still been no sign of a financial package of help for landlords whose tenants are struggling to pay rent. Or for tenants who cannot afford to pay their rent.

A comprehensive financial package is needed, to allow tenants to continue to pay their rent without building unmanageable debt.

SWLA are on the Independent Advisory Board panel along with other large landlord associations in England. We represent our members at national level and are working hard to encourage the Government to look at providing financial help to save tenancies and prevent huge debt.

We regularly write to MPs within the South West with difficulties that landlords face, our MP Panel members assist us in reaching every MP for maximum effect.

Ben Beadle, NRLA chief executive says: “The repossessions ban is a sticking plaster that will ultimately lead to more people losing their homes. It means tenants’ debts will continue to mount to the point where they have no hope of paying them off leading eventually to them having to leave their home.

“Instead the Government should recognise the crisis facing many tenants and take immediate action to enable them to pay their debts as is happening in Scotland and Wales. The objective should be to sustain tenancies in the long term and not just the short term.”

This week Steve Lees, SWLA chair attended a Federation of Small Businesses online meeting with Ben Bradshaw MP (Exeter). Steve highlighted the Welsh ‘Tenancy Saver Loan Scheme’. The loan can be repaid over 5 years at an interest rate of 1% APR. More information onthe scheme in Wales can be read here; https://gov.wales/scheme-help-tenants-affected-coronavirus-launches-wales

And the Scottish Tenant Hardship Loan Fund information can be read here; https://www.gov.scot/news/increased-support-for-tenants/#:~:text=The%20Tenant%20Hardship%20Loan%20Fund,in%20response%20to%20the%20pandemic.

You can get involved by writing to your MP, calling for the Government to take action, and share the message through your social media channels.

https://www.gov.uk/government/news/breathing-space-to-help-millions-in-debt

The Government’s new Breathing Space period will freeze interest, fees and enforcement for people in problem debt, with further protections for those in mental health crisis treatment.

The scheme will ban banks and landlords from chasing tenants for unpaid debts, by offering them a period of time to try to find a solution to their financial problems. It will impact on landlords – particularly those seeking possession due to arrears.

The Debt Respite Scheme (also known as Breathing Space) will come into force in May 4.

There are two types of breathing space that a tenant may enter into:

Both types of breathing space operate in a similar way. Creditors are not allowed to contact them directly to request payment of the debt, or take enforcement action to recover the debt (including by taking possession of a property).

However, the duration and frequency of the breathing spaces vary. A ‘standard’ arrangement will last for a maximum of 60 days, for a mental health crisis breathing space, the Breathing Space ends 30 days after the tenant’s treatment ends.

Local authorities providing debt advice and FCA approved debt advisors can grant Breathing Spaces to people in debt – they would be expected to speak to them the establish whether this is the best thing for them.

Millions of people with problem debt, including those facing mental health problems, will be helped by the government to get their finances under control.

A 60-day breathing space period will see enforcement action from creditors halted and interest frozen for people with problem debt. During this period, individuals will receive professional debt advice to find a long-term solution to their financial difficulties.

As well as this, those receiving mental health crisis treatment will receive the same protections until their treatment is complete, in acknowledgement of the clear impact problem debt can have on wellbeing.

The impact assessment for breathing space, published today, forecasts that it will help over 700,000 people across the UK get professional help in its first year, increasing up to 1.2 million a year by the tenth year of operation.

For further information see; https://www.gov.uk/government/publications/debt-respite-scheme-breathing-space-guidance

https://www.gov.uk/check-tenant-right-to-rent-documents/how-to-check

Right to rent checks continue in the same way as now until 30 June 2021 for citizens of the EU, Switzerland, Norway, Iceland and Liechtenstein.

Continue checking their passport or national identity card as before. For family members of EU, EEA or Swiss citizens, follow the usual guidance for documents you can accept for right to rent checks.

It’s against the law to ask EU, EEA or Swiss citizens to show that they have settled status or pre-settled status when starting a new tenancy.

You will not need to make retrospective checks for existing tenants from 2021.

In June 2021 , new guidance will be published covering how landlords can perform right to rent checks for EEA nationals.

The Electrical Safety Standards in the Private Rented

Sector (England) Regulations 2020

These Regulations apply in England to –

**note, if a pre 01 July 2020 tenancy rolls onto a statutory periodic tenancy after 01 July 2020, the Regulations will apply**

Here are a few frequently asked questions & answers from NICEIC & ELECSA;

HAS COVID-19 PROMPTED A CHANGE TO THE PRS LEGISLATION?

No, It is important to note that PRS legislation and timings have not changed. Full details on the regulations, including information relating to the steps landlords, can take if they cannot find an inspector or if they are unable to gain access to a property in normal circumstances can be viewed here; Guide for landlords: electrical safety standards in the private rented sector – GOV.UK (www.gov.uk)

WHAT ACTION WILL BE TAKEN IF LANDLORDS AND INSPECTORS ARE UNABLE TO COMPLY DUE TO COVID-19 ACCESS ISSUES?

While the regulation and the schedule hasn’t changed, MHCLG issued COVID-19 specific guidance for landlord, tenants and local authorities. Encouraging local authorities to take a pragmatic, risk-based and common-sense approach to enforcement during COVID-19 the advice outlines reasonable steps landlords should take in the interim period.

A topline summary of this updated guidance and how it relates to PRS electrical safety checks is shown below:

• A landlord is not in breach of their duty to comply with a remedial notice if they can show they have taken all reasonable steps to comply.

• A landlord could show reasonable steps by keeping copies of all communications they have had with tenants and electricians as they attempt to make arrangements to carry out the work, including any replies

• Landlords may also wish to provide other evidence which shows the electrical installation is in a good condition while they attempt to arrange works. This could include the servicing record and previous condition reports.

• A landlord who has been prevented from accessing the premises will not be required to begin legal proceedings against their tenant to show that all reasonable steps have been taken to comply with their duties.

Landlords of privately rented accommodation must:

MORE INFORMATION

To view the full COVID-19 and renting: guidance for landlords, tenants and local authorities document, please see; Guidance for landlords and tenants – GOV.UK (www.gov.uk)

Please see the SWLA trade listing for local electricians; https://www.landlordssouthwest.co.uk/tradelistings/electricians-pat-electrical-services/

Or search the following;

Information from gov.uk and NICEIC & ELECSA (electrical governing bodies)

https://www.gov.uk/government/news/extra-covid-protections-for-rough-sleepers-and-renters

The ban on bailiff enforced evictions has been extended.

Renters will continue to be supported during the new national restrictions, with an extension to the ban on bailiff evictions for all but the most egregious cases for at least 6 weeks – until at least 21 February – with measures kept under review.

Court rules and procedures introduced in September to support both tenants and landlords will remain in place and regularly reviewed. The courts will continue to prioritise cases, such as those involving anti-social behaviour, illegal occupation and perpetrators of domestic abuse in the social sector.

Landlords continue to be required to give 6-month notice periods to tenants until at least 31 March except in the most serious circumstances.

The government has changed the law in England to ensure bailiffs do not enforce evictions for 6 weeks until 22 February, with no evictions expected to 8 March at the earliest. This will be kept under review.

The only exceptions to this are for the most egregious cases – anti-social behaviour, illegal occupation, death of a tenant where the property is unoccupied, fraud, perpetrators of domestic abuse in social housing and extreme rent arrears equivalent to 6 months’ rent.

Guidance to support landlords and tenants in the social and private rented sectors understand the possession action process and new rules within the court system in England and Wales is available.

For those renters who require additional support, there is an existing £180 million of government funding for Discretionary Housing Payments for councils to distribute to support renters with housing costs.

Our office remains open as normal for telephone and email queries (office hours 10am – 3pm Monday to Friday). If you call outside of these hours, please leave a message.

We are closed for visitors to help keep members and staff as safe as possible.

Take care, from the SWLA staff and committee.

The following guidance should be followed immediately; the law will be updated to reflect these new rules;

https://www.gov.uk/guidance/national-lockdown-stay-at-home

You must not leave, or be outside of your home except where necessary (see above guidance for further information on what you can and cannot do).

Landlords, you may leave home to fulfil legal obligations or to carry out activities related to buying, selling, letting or renting a residential property.

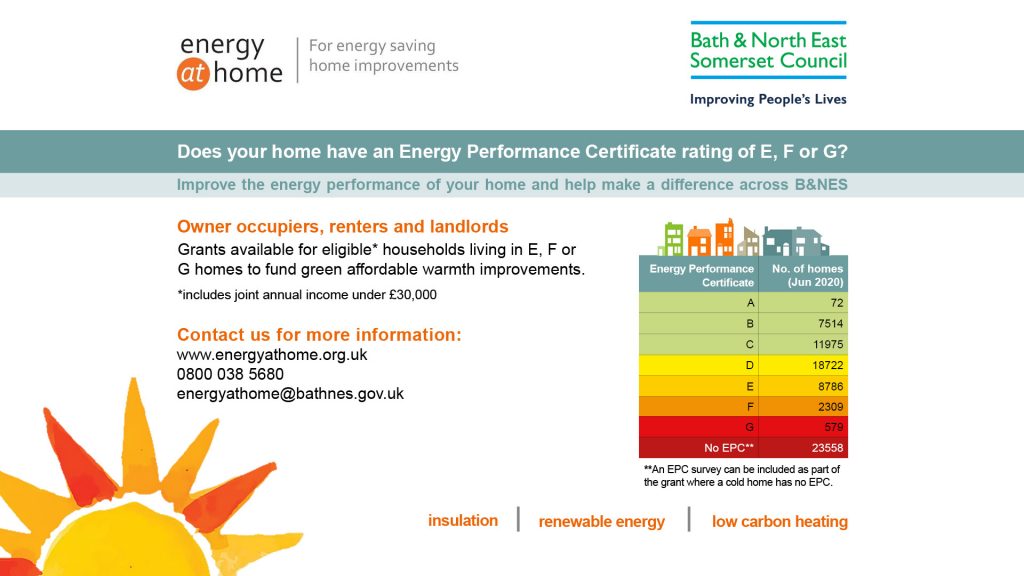

Owner occupiers, renters and landlords. Grants available for eligible* households living in E, F or G homes to fund green affordable warmth improvements.

*includes joint annual income under £30,000

Contact for more information:

www.energyathome.org.uk

0800 038 5680

energyathome@bathnes.gov.uk

SWLA’s December bulletin has been posted to members.

If you prefer to read it electronically, you can read in online; December Bulletin

You can also read previous issues; Latest Bulletins

How to Rent Guide Updated – 10th December 2020

https://www.gov.uk/government/publications/how-to-rent

It is mandatory for landlords to provide the latest version of the ‘How to rent: a checklist for renting in England’ to tenants before a tenancy starts – and on renewal of the tenancy if there has been an update to the contents of the guide.

SWLA recommend that landlords give the guide to tenants at the start of each new tenancy and at the start of each renewal (new fixed term), ensuring that there is no doubt that the tenant has received the most up to date version.

Landlords should obtain the How to Rent Guide directly from the gov.uk website to ensure that the most up to date copy is provided.

How to Let Guide Updated – 10th December 2020

https://www.gov.uk/government/publications/how-to-let

The How to Let Guide for landlords has also been updated, It explains the responsibilities, legal requirements and best practice for letting a property in the private rented sector.

How to rent a Safe Home Guide Updated – 10th December 2020

https://www.gov.uk/government/publications/how-to-rent-a-safe-home

This guide is for social and private rented sector tenants and explains the main hazards which may make a property unsafe to live in.

It explains tenants’ and landlords’ obligations and how to raise concerns.