In store and online. Friday 10th – Monday 13th June 2022

New Regulations drafted state, that all rented properties in England must provide a carbon monoxide alarm in rooms used as living accommodation where there is a fixed combustion appliance, such as gas heaters and boilers, from the beginning of October 2022.

The new draft rules amend the Smoke and Carbon Monoxide Alarm (England) Regulations 2015 where previously the requirement only applied to solid fuel combustion appliances, such as wood burners. The rules will, however, not extend to gas cookers.

The amended rules (Smoke and Carbon Monoxide Alarm (Amendment) Regulations 2022) include a new requirement to ensure when a tenant reports to the landlord or letting agent that an alarm may not be in proper working order, the alarm must be repaired or replaced.

The Draft Statutory Instrument was laid before Parliament on 11 May 2022 and once approved will come into force on 1 October 2022.

Article from PropertyMark https://www.propertymark.co.uk/resource/smoke-and-carbon-monoxide-alarms-compulsory-from-1-october.html

It was great to see some of our members at the Landlord Expo at Ashton Gate, Bristol on Tuesday. We also spoke to lots of landlords who are keen to sign up to the SWLA and attend our Landlord Accreditation and Training courses. The training courses are currently running online – which is great for our members who live further afield.

The day was well attended by exhibitors and delegates. It was good to be back to the hustle and bustle after all of the online meetings of the last couple of years!

Renters Reform Bill

The Queen’s Speech included reconfirmation of the government’s commitment to legislating on the Renters Reform Bill. This will include;

The Bill was first proposed in 2019 so landlords have been expecting this change for a long while.

The Renter’s Reform Bill white paper will be ‘published shortly’.

Reforming the UK’s Data Protection Regime

As the UK is no longer a members of the EU, the government are looking to reform the UK’s Data Protection regime, a Bill is expected, due to be published in summer 2022.

For the full speech contents; https://www.gov.uk/government/speeches/queens-speech-2022

Understanding Self Assessment can be challenging for many self-employed people. The technical information can be difficult if not impossible to understand, while – let’s face it – it’s hardly the most interesting subject.

And the use of tax terminology rather than plain English can literally leave many people scratching their head when they’re reading information that should guide them.

Here are a few basic facts that you should know about how Self Assessment works if you’re self-employed, as well as plain English explanations of key Self Assessments terms that’ll you’ll often read or hear.

What is Self Assessment and how does it work?

Self Assessment glossary – what does the jargon actually mean?

Accounting year – the 12-month period covered by your business’s accounts, which may or not be the same as the UK tax year (ie 6 April-5 April).

Allowable expenses – business costs that HMRC allows you to deduct from your profits. These reduce your profits and resulting Income Tax bill.

Annuities – a long-term investment issued by an insurance company that’s designed to protect you from the risk of outliving your income. If applicable, details must be given in your Self Assessment tax return.

Balance sheet – a report (usually produced by accounting software) showing a business’s assets and liabilities at a specific time or at the end of the trading or tax year.

Capital allowances – to reduce your profits and Income Tax bill, you can claim capital allowances when you buy capital assets that you keep for use in your business (eg equipment, machinery and vehicles).

Capital Gains Tax – a tax on the profit you make when you “dispose of” (ie sell) an asset (eg property) for more than you paid for it. You provide details of your gain via Self Assessment and pay tax on the gain.

Gross profit – your total sales (also called your “turnover”) minus your cost of sales and direct costs. Your cost of sales are your day-to-day business running costs (ie your overheads or fixed costs), while direct (or variable) costs are those linked directly to the production/supply of specific goods or services.

Income – money your business receives for the products and/or services it sells to its customers. The money you receive is your personal income.

Late-filing – when you fail to submit your Self Assessment tax return before the deadline. You’ll pay a late-filing penalty of £100 if your tax return is up to three months late (more if it’s later or if you also pay your tax bill late).

Marriage Allowance – enables you to transfer £1,260 of your Personal Allowance to your husband, wife or civil partner, thereby reducing their tax by up to £252 in the tax year.

National Insurance contributions – contributions you pay to qualify for certain benefits and the State Pension. Self-employed people pay Class 2 and Class 4 National Insurance contributions (NICs).

Net profit – your gross (ie total) profit minus indirect costs and expenses.

NINO – National Insurance number; ensures that your National Insurance contributions (NICs) and tax are only recorded against your name.

Ordinary partnership – a business formed by two or more self-employed people. In law, the people and their business are the same thing, so the partners are both liable for the partnership’s debts.

Personal Allowance – the standard Personal Allowance is £12,570 (2022/23 tax year). This is the amount of income that you can earn without having to pay tax.

Revenue – total income generated by the sale of goods and services that your sole trader business makes.

SA100 – the main Self Assessment tax return that you need to fill out and file. Sole traders often have to complete and file supplementary pages to provide more details about their income or expenses.

Self Assessment – the system that the UK tax authority HMRC (HM Revenue and Customs) uses to collect Income Tax.

Self-employed – working for yourself as a freelancer, contractor, agency worker or business owner, rather than being employed by an employer.

Simplified expenses – a quicker and more convenient way of calculating some business expenses using flat rates instead of working out the actual cost. HMRC allows this. Can be used for vehicle and fuel costs.

Sole trader – an alternative term for being self-employed. In law, there’s no distinction between you and your business. You can keep all of the profits after you’ve paid tax on them – but you’re personally liable for business debts.

Tax relief – these enable you to pay less tax to cover money you’ve spent on business expenses or costs if you’re self-employed or to get back tax or have it repaid in another way (eg into a personal pension). You get some types of tax relief automatically, but you must apply for others.

Tax year – 12-month period covered by a Self Assessment tax return. It’s the same for everyone who pays tax via Self Assessment – 6 April until 5 April the following year.

Trading allowance – the first £1,000 of income that you earn from self-employment is your trading allowance and it isn’t subject to tax.

UTR – Unique Taxpayer Reference – a 10-digit code HMRC uses to identify self-employed people and their businesses for tax purposes. You need to include it in your Self Assessment tax return.

Article by GoSimpleTax

GoSimpleTax is jargon free software which allows you to record income, expenses and submits directly to HMRC.

It is a solution for the self-employed landlord, sole traders, freelancers and anyone with income outside of PAYE.

The software will provide you with hints and tips that could save you money on allowances and expenses you may have missed.

Discounts for SWLA members; GoSimpleTax

The Building Safety Bill received Royal Assent on 28th April and was passed into law – however it won’t come into force for two months. The conclusion of the bill process sees confirmation about the level of funding available for the remediation of unsafe cladding in medium-rise buildings (11-18 metres high) in England.

The UK Government reversed its original suggestion to completely exclude leaseholder landlords from plans for developers to cover the cost of cladding remediation in medium-rise blocks.

Under the new legislation, owners of up to three properties in the UK will qualify for the protections. This includes all properties, not just those which require remediation – for example, an owner-occupied principal home plus two let properties.

Landlords with larger portfolios will be excluded from the protections unless the affected property is their primary residence, despite widespread support across the political spectrum for provisions to be extended.

Non-cladding defects

For non-cladding remediation, developers and then building owners will be expected to cover these costs where possible. Building owners will be legally required to prove there are no other sources for funding before passing any costs onto leaseholders.

Building owners will not be able to pass costs onto qualifying leaseholders where they are, or are linked to, the developer or where they have sufficient net wealth.

In the remaining cases, the cost of remediation of non-cladding defects and interim measures, such as waking watches, will be shared between the building owner and leaseholders. Qualifying leaseholders (as outlined above) will be protected by a cap:

The costs will be spread over 10 years, and any payments for non-cladding defects or interim measures made in the last five years will count towards the cost cap. The building owner will be responsible for any costs above the cap.

There will be no protections for leaseholders in buildings less than 11 metres high, as the Government considers there’s “no systematic fire risk”. Buildings over 18 metres high continue to be covered by the Building Safety Fund.

The Government guidance on the leaseholder protections is available on the GOV.UK website.

Other measures

The Building Safety Bill is an extensive piece of legislation, addressing issues raised by the Grenfell Tower fire and subsequent inquiry. Other provisions include:

Implementation of the full scope of the legislation is expected to take 12-18 months.

Article abridged from; NRLA

Further information; Building safety leaseholder protections factsheet

All benefit claimants will be moved over to Universal Credit by the end of 2024, with moves from legacy schemes resuming next month, the Department for Work and Pensions announced today.

Today’s announcement reaffirms the Government’s target to complete the programme. The restart follows a pause to the process during the pandemic when staff were focused on supporting the surge of new claimants to Universal Credit.

The six benefits being replaced all have complex and inefficient systems based on aging, inflexible IT. Universal Credit uses a modern, digital system which stood up to the test of Covid-19 where it quickly ensured three million new claimants were protected from the financial impact of the pandemic.

Universal Credit also provides claimants with one to one individually tailored support to help them into employment or to further their career, and people with a health condition or disability who cannot work could receive almost £350 a month on top of the Universal Credit standard allowance. Additional support remains available for those in need, including the Household Support Fund and Discretionary Housing Payments.

The process will resume on 9 May and will be carefully managed. Claimants will gradually be notified of when they will be asked to move to Universal Credit so as to complete the process by 2024.

Everyone moving over from legacy benefits will have their entitlement to Universal Credit assessed against their current claims, with top up payments available for eligible claimants whose entitlement would have been reduced because of the change – ensuring they receive the same entitlement as on a legacy system. These will continue unless their circumstances alter.

Secretary of State for Work and Pensions Thérèse Coffey said:

Over five million people are already supported by Universal Credit. It is a dynamic system which adjusts as people earn more or indeed less, and simplifies our safety net for those who cannot work.

Parliament voted to end the complex web of six legacy benefits in 2012, and as this work approaches its conclusion we are fully transitioning to a modern benefit, suited to the 21st century.

Although notifications will be gradually sent out across the country, people who are currently claiming legacy benefits do not have to wait to be moved to Universal Credit. Anyone who thinks they will be better off can move straight away. Claimants can check their entitlement for Universal Credit using an independent benefits calculator.

People who are unsure whether they would be better off should wait to be moved as the transitional protection top up payments only apply to claimants moved by DWP, and people cannot reclaim their old benefits after switching to Universal Credit.

Claimants can also use the separate Help to Claim service for support.

A dedicated helpline – signposted on the notice claimants receive – will provide support to make their Universal Credit claim, and guidance will also be available online. Those in need of further support can also visit their local jobcentre.

Claimants moving to Universal Credit will receive a two-week run-on of their Income Support, Income-Based Jobseeker’s Allowance, or Income-Related Employment and Support Allowance. Those moving from Housing Benefit will receive a two-week Transition to Universal Credit Housing Payment.

Article from; https://www.gov.uk/government/news/managed-move-of-claimants-to-universal-credit-set-to-restart

The Fuel Direct Scheme enables energy suppliers and benefit claimants to apply deductions for energy arrears from benefits. In light of the significant increase in energy bills, the Department for Work and Pensions (DWP) has written to UK energy suppliers about plans to temporarily pause requests to pay for ongoing energy usage from benefits from 1 April.

The DWP will no longer facilitate requests from energy suppliers for new or increased ongoing consumption payments in an effort to ease the cost of living pressures for those on lower incomes.

From 1 April, only claimants will be able to request an increase or decrease in ongoing consumption payments for a period of one year. By doing so, they will have greater control over the amount that can be deducted directly from their benefits. If they are able, claimants can contact the DWP and request an increase in payments.

Energy suppliers have been provided with reassurance that existing ongoing consumption payments will be maintained at their current levels.

Article from; National Housing Federation – Temporary pause on energy usage deductions from benefits

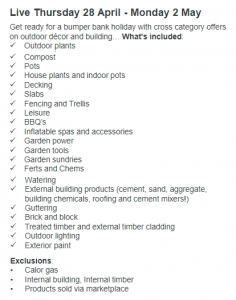

From Thursday 28th April – Monday 2nd May

For all deals including 20% off bathrooms, kitchens and bedroom furniture – see the TradePoint website – www.trade-point.co.uk

On Wednesday 20th April we welcomed over 60 members to our General Meeting at the Future Inn Hotel.

Thanks to our brilliant speakers – Mick Quick from Tech Surveys who discussed forthcoming changes to EPC legislation and what landlords can do about it. Also Annette Stone & Ian Pring from Thomas Westcott Chartered Accountants who advised on all landlord tax matters with a focus on Making Tax Digital, Capital Gains Tax and Stamp Duty Land Tax.

We had lots of interesting queries raised from the audience – if anyone did not have a chance to ask their question at the meeting, please email into the office and our speakers will happily provide an answer.

Thank you to Adrian Feeney from Trade Point who had a stand, and was on hand to answer members TradePoint discount queries. Remember – SWLA members get 10% of most items in B&Q via the TradePoint SWLA membership discount.

We look forward to seeing you all again at our next General Meeting on 19th October 2022.

Article by GoSimpleTax

April marks the start of the 2022/23 UK tax year, while also being the month when HMRC introduces some important tax changes.

These can affect landlords just as much as other taxpayers and in some cases they can have a significant impact on your tax bills. With prices rising sharply seemingly across the board, you should be aware of how much more tax you’ll have to pay as a landlord, so that you can better budget for the year ahead. The April 2022 tax changes could also affect income you receive from other sources.

So, what key tax changes are being introduced for the 2022/23 tax year and how could they affect you and other landlords?

National Insurance Contributions

As widely reported when announced in the government’s October 2021 Budget, from 6 April 2022, National Insurance contributions (NICs) will increase by 1.25 percentage points (which is much higher than a 1.25% increase). The government says the additional tax revenue will be spent on the NHS and social care.

Rental income is not subject to NICs unless you’re a professional landlord running a property rental business (ie being a landlord is your main job, you rent out more than one property and buy new properties to rent out, etc). If you are a professional landlord running a property rental business, currently you must pay NICs if your earnings exceed the Class 2 and Class 4 NIC thresholds.

Obviously, if you’re not a professional landlord but you earn income from other sources upon which you currently pay NICs, for example, if you’re an employee, sole trader or member of an ordinary partnership, your NICs will increase by 1.25 percentage points. If you employ people, your share of their Class 1 NICs will also increase, while any Class 1A and 1B payments employers pay on employee expenses and benefits will also increase.

What about Income Tax?

Not much will change when it comes to Income Tax. The personal allowance (ie the amount upon which no Income Tax is payable) remains at £12,570 a year (ie £1,048 a month or £242 a week). Beyond this figure, in England, Wales and Northern Ireland, 20% Income Tax (ie the basic rate) is payable on taxable earnings between £12,571 and £50,270 a year, then 40% (the higher rate) on £50,271 to £150,000 and 45% on annual earnings over £150,000. The tax rates in Scotland are different, but the personal allowance is the same.

Other tax-related changes for landlords

Tax on dividend income will also increase by 1.25% from 6 April. If you earn any income from dividend payments, after your £2,000 annual allowance, if you’re a basic rate Income Tax payer you’ll pay 8.75% tax on dividend payments (7.5% was the previous percentage). If you’re a higher rate Income Tax payer, from 6 April you’ll pay 33.75% (up from 32.5%) and additional rate Income Tax payers will pay 39.35% (up from 38.1%) on their dividend income.

A reminder that Capital Gains Tax rules changed in October 2021 in a way that could benefit you if you choose to sell property this year. Previously, you would have had just 30 days to report any taxable gains made from the sale of property and pay the CGT you owed to HMRC, but you now have up to 60 days. The same amount of Capital Gains Tax is payable, it’s just that have twice as much time to report and pay tax on any taxable gains.

Making Tax Digital for landlords

From April 1 2022, landlords with a VAT-registered business with a taxable turnover below the VAT threshold of £85,000 will need to comply with Making Tax Digital for VAT requirements. These mean you must maintain digital records using MTD-compatible software and report figures online to HMRC each quarter. More information about Making Tax Digital for VAT is available from HMRC via government website gov.uk.

It’s still some way off, but all current Self Assessment taxpayers will need to comply with Making Tax Digital for Income Tax requirements when they are introduced. Beginning in April 2024, this will also require you to use MTD-compatible software to maintain digital records of your income and outgoings. You’ll need to send quarterly updates to HMRC online and submit an end-of-period statement and final declaration, so that your tax liability can be calculated. You’ll no longer need to complete a Self Assessment tax return once MTD for Income Tax Self Assessment is introduced.

Income, Expenses and tax submission all in one.

GoSimpleTax will provide you with tips that could save you money on allowances and expenses you might have missed.

The software submits directly to HMRC and is the solution for the self-employed, sole traders and anyone with income outside of PAYE to file their self-assessment giving hints and tips on savings along the way.

GoSimpleTax does all the calculations for you saving you ££’s on accountancy fees. Available on desktop or mobile application.

The following ‘easy to use’ guide breaks down all benefits and schemes available in the UK – click on each topic for more information.

IncomeMax-X-BGET-BounceBack-Checklist-BGET-2021.pdf (britishgasenergytrust.org.uk)

For the attention of landlords with properties in the Plymouth area, please note that there is information, guidance and support available on energy performance improvements. Plymouth City Council and Plymouth Energy Community are working together to support landlords to meet Minimum energy Efficiency Standards, without the need for enforcement. Please check out the link below or contact Plymouth Energy Community directly to find out more;

https://plymouthenergycommunity.com/business/mees?r=11154

https://www.landlordssouthwest.co.uk/wp-content/uploads/2022/03/PCC-and-PEC-Advert-180222.pdf

Chancellor announces tax cuts to support families with cost of living – GOV.UK (www.gov.uk)

Rishi Sunak announced that National Insurance starting thresholds will rise to £12,570 from July, meaning hard-working people across the UK will keep more of what they earn before they start paying personal taxes.

The cut, worth over £6 billion, will benefit almost 30 million working people with a typical employee saving over £330 in the year from July. This means the UK now has some of the most generous tax thresholds in the world.

Mr Sunak also announced that fuel duty for petrol and diesel will be cut by 5p per litre from 6pm tonight (23 March) to help drivers across the UK with rising costs – a tax cut worth £2.4 billion. This is the biggest cut ever on all fuel duty rates and means a one-car family will now save on average £100.

To let people keep more of what they earn, the basic rate of income tax will also be cut by 1p in the pound in 2024, when the OBR expect inflation to be back under control, debt falling sustainably and the economy growing. The cut is worth £5 billion for workers, savers and pensioners and will be the first cut to the basic rate in 16 years.

The Chancellor also set out a series of measures to help businesses boost investment, innovation, and growth – including a £1,000 increase to Employment Allowance to benefit around half a million smaller firms.

Delivering the Spring Statement, Chancellor Rishi Sunak said:

This statement puts billions back into the pockets of people across the UK and delivers the biggest net cut to personal taxes in over a quarter of a century.

Like our actions against Russia, I have been able to do this because of our strong economy and the difficult but responsible decisions I have had to make to rebuild our finances following the pandemic.

Cutting taxes means people have immediate help with the rising cost of living, businesses have better conditions to invest and grow tomorrow, and people keep more of what they earn for years to come.

Delivering the statement, the Chancellor made clear that our sanctions against Russia will not be cost-free for people at home, and that Putin’s invasion presents a risk to our economic recovery – as it does to countries all around the world.

However, announcing the further measures to help people deal with rising costs, he said the extra support could only be provided because of the UK’s strong economy and the tough but responsible decisions taken to rebuild our fiscal resilience.

The immediate help for people with the cost of living and support for businesses comes as part of a wider Tax Plan announced by the Chancellor that will also create better conditions for growth and will share proceeds from growth more fairly – ensuring people can keep more of what they earn.

The Chancellor said that global supply chain issues following the pandemic, as well as Russia’s invasion of Ukraine, are driving up the cost of living for families across the UK.

To combat this, he announced that from 6pm this evening (23 March) fuel duty will be cut by 5p per litre for 12 months – worth £2.4 billion for hard-working families across the UK.

To ease cost of living pressures for almost 30 million employees, the Chancellor announced that from July 2022, National Insurance thresholds will rise to £12,570 to align with the income tax personal allowance. This simplification means that, from July, 70% of workers who pay NICs will pay less of it, even after accounting for the Health and Social Care Levy. Of those who benefit from the threshold increase, 2.2 million people will be taken out of paying NICs altogether.

To ensure more people can keep more of what they earn for years to come, the Chancellor also announced plans to cut the basic rate of income tax from 20p to 19p from 2024. The historic £5 billion tax cut for workers, pensioners and savers will be worth £175 on average for 30 million people and will be the first cut to the basic rate in 16 years. This will be delivered in a responsible and affordable way, while continuing to meet our fiscal rules.

Mr Sunak also announced that there will be an extra £500 million for the Household Support Fund, which doubles its total amount to £1 billion to support the most vulnerable families with their essentials over the coming months. The Chancellor also reduced the VAT on energy saving materials such as solar panels, heating pumps and roof insulation from 5% to zero for five years, helping families become more energy-efficient. This cost of living support comes on top of the measures that the Chancellor has already announced over the recent months to support families. This includes a £9 billion energy bill rebate package, worth up to £350 each for around 28 million households, an increase to the National Living Wage, worth £1,000 for full time workers, and a cut to the Universal Credit taper, worth £1,000 for two million families.

To lift growth and productivity among UK businesses, Mr Sunak set out plans to boost private sector investment and innovation and bring in a new culture of enterprise.

He increased the Employment Allowance – a relief which allows smaller businesses to reduce their employers National Insurance contributions bills each year – from £4,000 to £5,000. The cut is worth up to £1,000 for half a million smaller businesses and starts in two weeks’ time, on 6 April. As a result, 50,000 of these businesses will be taken out of paying NICs and the Health and Social Care Levy, taking the total number of firms not paying NICs and the Levy to 670,000.

The Chancellor also announced two new business rates reliefs will be brought forward by a year to come into effect in April 2022. There will be no business rates due on a range of green technology used to decarbonise buildings, including solar panels and batteries, whilst eligible heat networks will also receive 100% relief. Together these will save businesses more than £200 million over the next five years.

Ahead of the end of the super-deduction, the government will work with businesses and other stakeholders to consider cuts and reforms to best support future investment. And with UK employers spending just half the European average on training their employees, the Chancellor said he will examine how the tax system – including the operation of the Apprenticeship Levy – can be used to encourage employers to invest in adult training.

The Chancellor committed to improving R&D reliefs too. UK business R&D investment is less than half of the OECD’s average as a percentage of GDP, so R&D tax reliefs will be reformed to deliver better value for money for the taxpayer while being more generous where they can make the most difference. The scope of reliefs will also be expanded to cover data, cloud computing and pure maths.

The support for SMEs comes on top of 50% business rates relief for eligible retail, hospitality, and leisure properties, also coming in this April and worth £1.7 billion for small businesses. The Help to Grow Management and Digital schemes, worth thousands of pounds per business, and the £1 million Annual Investment Allowance are also available to continue supporting UK businesses.

The Spring Statement also confirms that:

UK individuals, charities, community groups and businesses can now record their interest in supporting Ukrainians fleeing the war through the government’s new Homes for Ukraine scheme.

launched a webpage for sponsors to record their interest, ahead of Phase One of the scheme opening for applications this Friday.

The Homes for Ukraine scheme will allow individuals, charities, community groups and businesses in the UK to bring Ukrainians to safety – including those with no family ties to the UK.

Phase One of the scheme will allow sponsors in the UK to nominate a named Ukrainian or a named Ukrainian family to stay with them in their home or in a separate property.

Individual sponsors will be asked to provide homes or a spare room rent-free for as long as they are able, with a minimum stay of 6 months. In return, they will receive £350 per month.

Those who have a named Ukrainian they wish to sponsor should contact them directly and prepare to fill in a visa application, with the application launching on Friday 18 March.

Charities, faith groups and local community organisations are also helping to facilitate connections between individuals, for potential sponsors who do not have a named contact.

Ukrainians arriving in the UK under this scheme will be granted 3 years leave to remain, with entitlement to work, and access benefits and public services.

Applicants will be vetted and will undergo security checks.

For further information please see here; https://homesforukraine.campaign.gov.uk/

Frequently Asked Questions

https://www.gov.uk/guidance/homes-for-ukraine-scheme-frequently-asked-questions

The government has published a call for evidence on Income Tax Self Assessment registration for the self-employed and landlords. You can find it at: Open consultation overview: Call for evidence: Income Tax Self Assessment registration for the self-employed and landlords – GOV.UK (www.gov.uk).

The closing date for the call for evidence is 22 March 2022

Interest rates have increased for the third time in four months as the Bank of England tries to calm the rise in the cost of living.

The rise to 0.75% from 0.5% comes as prices are climbing faster than pay, squeezing household finances.

It means interest rates are now at their highest level since March 2020, when the Covid pandemic began.

Energy bills and food costs are increasing and there is concern the war in Ukraine will push prices up further.

Inflation, the rate at which prices rise, is currently at 5.5%, well above the Bank of England’s 2% target. The Bank expects inflation to reach 8%, and possibly higher, in coming months.

The Bank’s policymakers cited rising prices and strong employment as the reasons for the latest rise.

The members of the Monetary Policy Committee (MPC) felt that “given the current tightness of the labour market, continuing signs of robust domestic cost and price pressures, and the risk that those pressures will persist,” an interest rate rise was justified.

The MPC voted by a majority of 8-1 for the measure, with deputy Bank governor Jon Cunliffe the only member to vote for keeping rates unchanged. He said this was because of the impact of rapid price rises on household incomes.

The committee said that more interest rate rises “might be appropriate in coming months, but there were risks on both sides of that judgement depending on how medium-term prospects evolved.”

The invasion of Ukraine was likely to push prices up even faster than the Bank expected at its last meeting in February, it said.

“The economy had recently been subject to a succession of very large shocks. Russia’s invasion of Ukraine was another such shock,” it wrote.

About two million households will see an immediate increase in their mortgage payments as a result of the rise in rates, according to UK Finance.

The increase will add about £26 a month to the cost of a typical tracker mortgage, and £16 to the cost of a typical standard variable rate mortgage.

The Bank said that higher global prices for energy and other goods were responsible for the faster rise in inflation than the MPC predicted at its last rate-setting meeting.

However, it expects inflation to “fall back materially” once prices stop rising and the impact of inflation on household incomes starts to bite.

Article from BBC News; https://www.bbc.co.uk/news/business-60763740

**PLEASE NOTE – THIS IS NOT AN SWLA WEBINAR – PLEASE SIGN UP BY CLICKING THE LINK BELOW IF YOU WISH TO ATTEND**

https://www.goodlord.co/newsagent/webinars/right-to-rent-checks-preparing-for-new-digital-checks

When – 10am Thursday 17th March 2022

Subject– Everything you need to know about upcoming changes to Right to Rent

Where– Zoom Webinar

| Need more clarity on the right to rent process? From 6 April 2022, letting agents and landlords will be able to use certified Identity Service Providers (IDSPs) to digitally check the identity and eligibility of British and Irish Citizens to rent a property in England. Join David Smith as he talks through what agents and landlords need to know about using these new providers to stay compliant with their right to rent obligations. The following will be covered; • Identity Service Providers (IDSPs) • Checks carried out by IDSPs • Letting agents’ and landlords’ obligations |

The Government understands that people are concerned about pressure on household

budgets and is taking action to help.

Alongside the £9.1 billion Energy Bills Rebate announced on 3 February, it is providing £12

billion of support over this financial year and next to ease cost of living pressures, with help

targeted at working families, low-income households and the most vulnerable.

At the Autumn Budget:

• The National Living Wage will increase to £9.50 an hour this April, providing an extra

£1,000 pay for a full-time worker – this has risen every year since it was introduced in 2016

• The cuts to the Universal Credit taper rate and uplift to work allowance will put an

extra £1,000 extra a year into the pockets of two million low-income families.

• Fuel duty has been frozen for the twelfth year in a row, meaning the average driver

has saved £1,900 since 2010.

• All alcohol duties have been frozen for a third year in a row, providing a tax cut worth

£500m for families every year.

On top of job support schemes during the pandemic:

• The £500m Household Support Fund supports millions of households in England with

essentials over the coming months.

• The Holiday Activities and Food programme, worth up to £220m, provides enriching

activities and healthy meals to children across the country over Easter, the summer

and Christmas holidays.

• Four million families are getting help with their council tax bills.

• Councils have been given an extra £65m to support low-income households with rent

debts.

• Increased generosity of the Local Housing Allowance for housing benefit, with more

than 1.5m households benefiting from an additional £600 a year

• The £140 million Discretionary Housing Payments is supporting families with rent or

housing costs.

• Over 1 million NHS workers are receiving a 3 per cent pay rise.

Measures to support people with their energy bills:

• The Energy Bills Rebate will give the majority of households £350 of support with

rising energy bills, including a £200 discount on energy bills this Autumn and a £150

non-repayable reduction in Council Tax bills for all households in Bands A-D in

England. There will be £144 million of discretionary funding for Local Authorities to

support households who need support but are not eligible for the Council Tax

reduction.

• The Energy Price Cap is saving 15 million households £100 a year on average since

2019.

• Warm Home Discount provides a £140 rebate on energy bills each winter to over 2.2

million low-income households.

• Winter Fuel Payments to over 11.4 million pensioners at a cost of £2bn annually, with

£200 awarded to households with somebody who has reached State Pension age

and is under age 80 or £300 for households with somebody aged 80 and over.

• Cold Weather Payment providing £25 extra a week for poorer households when the

temperature is consistently below zero.

• The Energy Company Obligation has already installed 3.3 million measures in

2.3 million homes and we are increasing the amount energy suppliers invest in

energy efficiency measures for low-income households, extending ECO until 2026,

and, from April 2022, boosting its value from £640 million to £1 billion a year. This will

help an extra 305,000 families with green measures such as insulation, with average

energy bill savings of around £300 a year.

Additional measures in place:

• Doubled free childcare, providing working parents with up to 30 hours, worth up to

£5,000 per child every year. The Government has also introduced tax-free childcare,

providing working parents with up to £2,000 of childcare support a year. Under

Universal Credit, parents can claim back up to 85% of eligible childcare costs,

compared to 70% under the old system.

• The Social Housing Decarbonisation Fund and Sustainable Warmth programme is

estimated to save households an average of £350-450 per year, and future minimum

energy efficiency standards in the private rented sector will require landlords to

improve their properties’ energy performance, driving bills down.

• Increased the value of Healthy Start vouchers by over a third to help those in need

with young children, supporting them to buy fresh fruit and vegetables to boost the

long-term health of their children.

• Put a further £24 million into the National Breakfast Club programme, with the aim of

providing healthy breakfasts in up to 2500 schools in disadvantaged areas.

• Established the Money and Pensions Service in 2019, who provide free pensions

and money guidance, as well as debt advice in England.

• Introduced the 26-30 railcard, the Veteran’s Railcard, and the 16-17 rail Saver

enabling more people to benefit from discounts on rail travel.

• Investing a further £11.5bn in the Affordable Homes Programme from 2021-26, which

will deliver up to 180,000 affordable homes built from 2021 onwards.

• Pension Credit provides extra money to help with living costs for those over State

Pension age and on a low income. Claiming it also opens up further support like

Housing Benefit and Council Tax reduction schemes.

Cost_of_living_factsheet__energy__v2.pdf (publishing.service.gov.uk)

Levelling Up Secretary Michael Gove has rejected developers’ offer to remediate unsafe buildings while protecting leaseholders from escalating costs.

The building industry had suggested funding the remediation of fire safety defects in properties they had a role in developing above 11 metres, without drawing on the Building Safety Fund, and to offer refunds relating to buildings where money had already been handed out.

In a letter to the Home Builders Federation, Gove said the proposal, “fell short of full and unconditional self-remediation that I and leaseholders will expect us to agree”. He added: “I am disappointed to see you have not proposed a funding solution to cover the full outstanding cost to remediate unsafe cladding on buildings 11-18m.”

Gove said developers must commit to full self-remediation of unsafe buildings without added conditions or qualifications and has given the sector until the end of the month to agree a fully funded plan. “If an agreement is not reached by the end of March, I have been clear that government will impose a solution in law and have taken powers to impose this solution through the Building Safety Bill.”

Principal Residence

The government has already announced that portfolio landlords who own flats hit by the cladding scandal won’t be covered by the remediation fund; only those leaseholders who live in a property as their principal residence and accidental landlords – those who do not live in the property, but do not own any other residences – or who own only one other property are covered.

Gove added that another industry roundtable would meet at the end of March to finish discussions.

Article Abridged from Landlord Zone

Households across England are being urged to set up direct debits with their local council to automatically receive a council tax rebate that will help millions of families manage costs of living. 4 out of 5 households will benefit including around 95% of rented properties

People who pay council tax by direct debit, which is a safe, simple and quick way to pay will see the cash go directly into their bank accounts from April. Those who do not pay by direct debit will be contacted by their council and invited to make a claim.

Around 20 million households in council tax bands A to D – including 95% of rented properties – are set to benefit from the £3 billion council tax rebate, which does not have to be repaid. It is part of an extensive package of government measures to help families with rising energy costs.

An extra £144 million will also be given to councils to provide discretionary support to vulnerable households who may not qualify for the £150 council tax rebate. This includes people on low incomes in council tax bands E to H.

The council tax rebate is part of a £9.1 billon government support package, which from October, includes a further reduction of £200 on energy bills for domestic electricity customers.

The £200 energy reduction will help people manage the increase in energy bills by spreading the increased costs over a few years, so they are more manageable for households. It will be automatically recovered from people’s bills in equal £40 instalments over 5 years, beginning in 2023, when global wholesale gas prices are expected to come down.

The Warm Home Discount will also be expanded so nearly 3 million low-income households will benefit from a £150 discount.

What about HMO landlords who pay the Council Tax in their HMO properties?

We are not sure! HMO landlords pay the council tax and household bills. But one could argue that tenants pay the council tax and household bills within their rent. We will update our members with more information when we have it.

https://www.gov.uk/government/news/households-urged-to-get-ready-for-150-council-tax-rebate