Labour Confirms Minimum EPC ‘C’ by 2030 Requirement for Landlords

Labour has confirmed plans for all rented properties to achieve a minimum Energy Performance Certificate (EPC) grade C by 2030. This initiative was confirmed by

Labour has confirmed plans for all rented properties to achieve a minimum Energy Performance Certificate (EPC) grade C by 2030. This initiative was confirmed by

The Housing Minister (Matthew Pennycook) has ruled out the introduction of rent controls in England. The comments were made in a written response to a

The Bank of England has cut interest rates from 5.25% to 5%, the first drop since the onset of the pandemic in March 2020. Home

Over 40 Bills were announced at the State Opening of Parliament (in the King’s speech) on 17th July, including the Renters’ Rights Bill. Commentary about

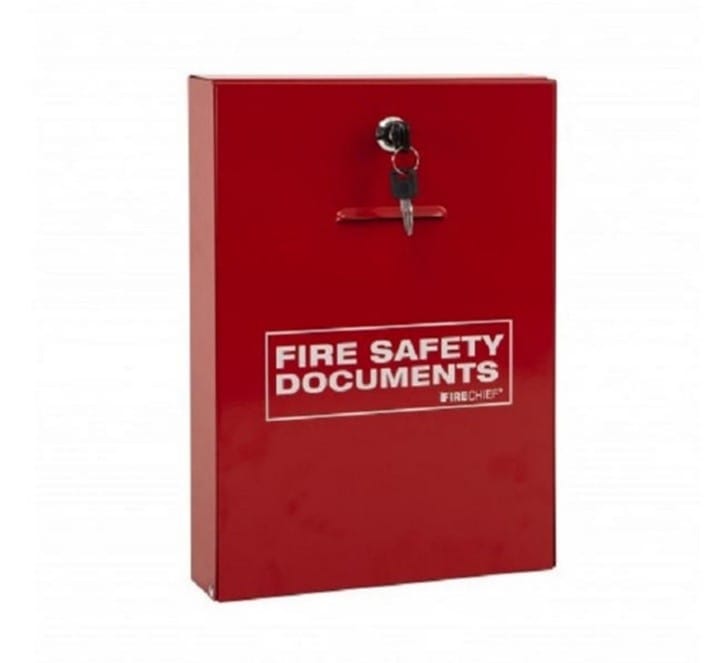

There is an item that you can place within a communal area of Flats or HMOs that can make a huge difference to the fire

It was great to see members old and new attend our open office event! We all had a lovely time catching up with everyone (and

Angela Rayner has been made Deputy Prime Minister and Secretary of State for the Ministry of Housing, Communities and Local Government. The department, which has

As Plymouth’s largest blinds showroom, Beacon Blinds stocks a comprehensive range of blinds, curtains and awnings. They are a local blinds supplier providing great value

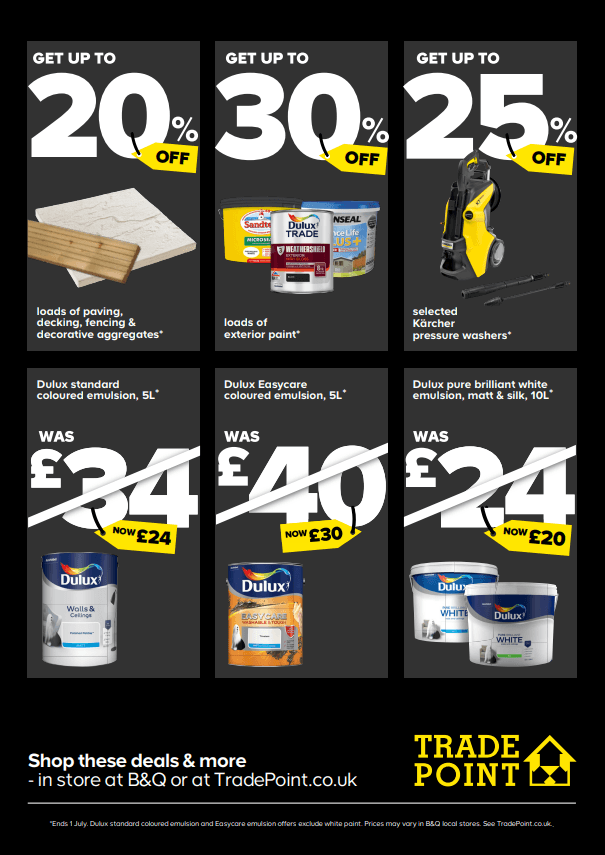

For all deals, visit The Big You Can Do It Sale | Tradepoint (trade-point.co.uk) from Friday 28th June.

Notice of a General Meeting Open afternoon in the SWLA Office Wednesday 10th July 2024 – 3pm – 6pm @ 30 Dale Road, Plymouth PL4

The President and Chairman met with Peter Gold (Prospective Parliamentary Candidate for Plymouth Sutton and Devonport. Central to the discussion were items on Reform’s Contract

Company No: 03670683 Registered Address: SWLA, 30 Dale Road, Plymouth, PL4 6PD – Website by GSL Media

Copyright © 2023 SWLA. All rights reserved