E-Bike Battery Fires on the Rise – Gov.uk Release Safety Guide

The news has been awash with reports of E-Bike battery fires and in this tragic case, the deaths within a young family; https://www.bbc.co.uk/news/articles/cd11gnqp27wo If your tenant

The news has been awash with reports of E-Bike battery fires and in this tragic case, the deaths within a young family; https://www.bbc.co.uk/news/articles/cd11gnqp27wo If your tenant

Wednesday 10th July from 3pm-6pm, pop in for a cream tea and a catch up! All welcome. SWLA Open Office Afternoon – South West

For over 35 years, Marks Electrical have been selling the best of appliances and televisions to over a million satisfied customers. Marks Electrical are offering

Whilst the Renters (Reform) Bill did not complete its passage. The Leasehold and Reform Act is now law and will come into force. We will

On Wednesday 15 May 2024, the Labour Housing Group hosted the launch of the report of the Independent Review of the Private Rented Sector. The

County lines | Devon & Cornwall Police (devon-cornwall.police.uk)

Perfect for landlords and property developers! SWLA Trade Discount members get an extra 10% off on top. For all ‘Refresh for Less’ deals, visit Search

Saturday 25th May until Monday 27th May 2024. Usual exemptions apply. If you are an SWLA member and have not yet applied for your

This month’s 30 minute Ashley Taylors Legal Webinar looks at the issues and problems that are arising with the Renters Reform proposals. It’s worth knowing

Landlord Accreditation Training Course – Face to Face Thursday 3rd October 2024 – 9:15 – 4:30pm Venue – Reception Room, Plymouth Council House, Armada Way,

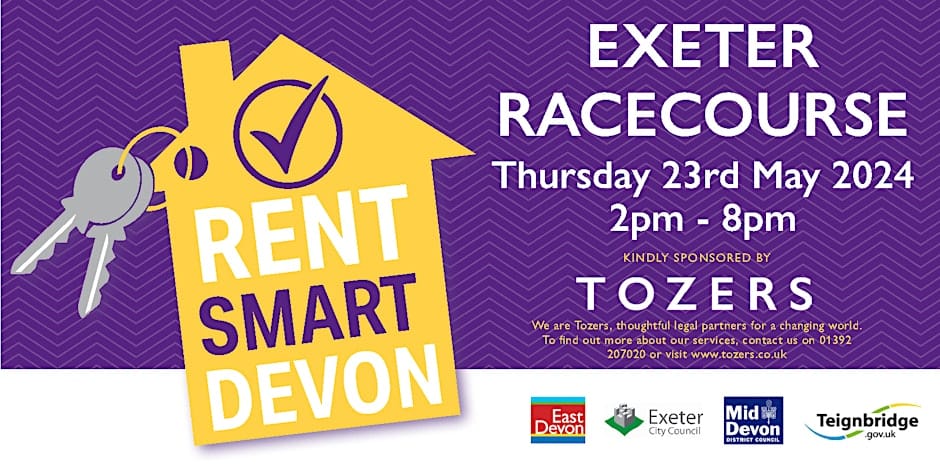

Teignbridge is hosting the following event jointly with East Devon District Council, Exeter City Council and Mid Devon District Council. SWLA have a stand at

Waste and HMOs: A Guide for Landlords and Managing Agents – by Plymouth City Council HMOs (Houses of Multiple Occupation) can present unique challenges when

Company No: 03670683 Registered Address: SWLA, 30 Dale Road, Plymouth, PL4 6PD – Website by GSL Media

Copyright © 2023 SWLA. All rights reserved