New HMO Licencing Schemes in Bristol

Bristol City Council’s Cabinet has now approved the two new schemes which were subject to a consultation last year. The two new schemes will come

Bristol City Council’s Cabinet has now approved the two new schemes which were subject to a consultation last year. The two new schemes will come

Landlord Accreditation Training Course – ONLINE Wednesday 1st May 2024 – 9:00 – 4:30pm Venue – Online Price – £65 for members of SWLA, £75

Thank you to members who attended our AGM this week, and thanks to members who sent their apologies. Steve Lees, SWLA Chair, lead the evening,

We often meet Shelter and Citizens Advice representatives at local housing meetings, so it was a welcome change to welcome Jack, Jaroslava and Sarah to

Exposure to mould can cause respiratory illnesses, allergies and asthma, and can sometimes be fatal. In 2020, two-year-old Awaab Ishak died after prolonged exposure to

As of 22nd January 2024 For landlords the fines increased from £80 per lodger and £1,000 per occupier for a first breach to up to

Plymouth City Council are working with South West Landlords Association to drive up the standards of accommodation on offer in our city. They are providing

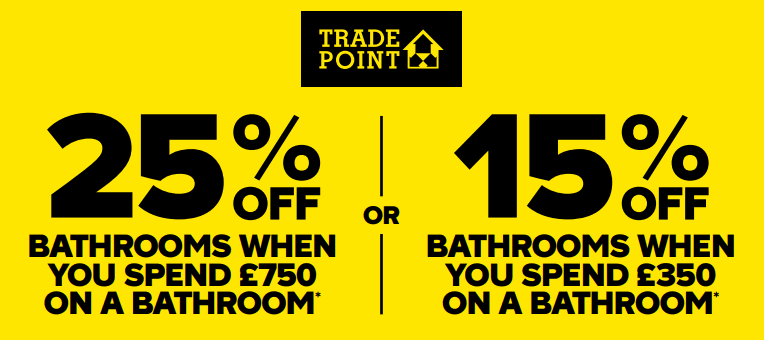

For further information see the TradePoint website; https://www.trade-point.co.uk/

A recent court case has highlighted the importance of landlords providing tenants with documentation. A new boiler was installed at the start of a tenancy,

Around 1.6 million private renters are set to receive a substantial boost to their housing support in April, as the Government lays legislation to increase

Company No: 03670683 Registered Address: SWLA, 30 Dale Road, Plymouth, PL4 6PD – Website by GSL Media

Copyright © 2023 SWLA. All rights reserved